17 Nov Offset A/R and A/P for Sales Reps

Offset A/R and A/P for Sales Reps

Q – I would like to know how to make deposits in QuickBooks Pro 2004 when my vendor invoices my customer for me and the customer pays my vendor and the vendor cuts me a check for the profit. I still make a PO and enter a bill to that vendor in QuickBooks. I also create an invoice in QuickBooks for that product to the customer. However, I do not send that invoice to the customer. It just helps me track what I pay for the product and what I sell it for. Is there any way to receive the payment and show that my vendor was paid without the payment to the vendor or full payment from the customer showing up in the back account? All I deposit in the “real” bank account is the check for the profit. Please help.

A – The short answer is that you will follow the same method using a bank clearing account with one little twist.

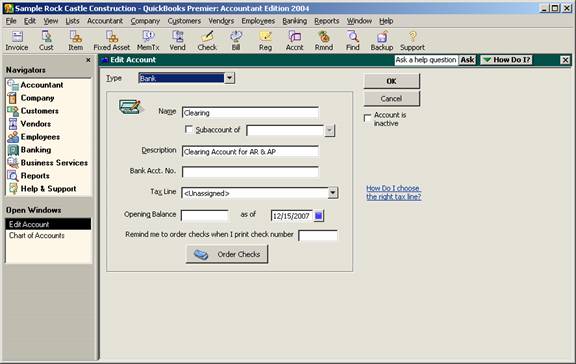

After the adding a new clearing account on the chart of accounts. As we have suggested, the type of the account should be bank. For our purposes here, we will name the account “Clearing.”

QBRA-2004: Lists > Chart of Accounts > Account > New

Next, choose Customers > Receive Payments and enter a payment to show the amount that is no longer outstanding (i.e. the invoice amount for the customer that relates to the profit check you have received). At the bottom of the screen, choose deposit to: Clearing. Note: Be careful the next time you receive a payment and change the bottom back (typically to “group with undeposited funds”).

QBRA-2004: Customers > Receive Payments

To record the reduction in Accounts Payable, choose Vendors > Pay Bills. At the bottom of the screen choose to pay be check using the Clearing account. Mark the bills to be paid in an amount that corresponds to the cost of the products that correspond to the profit check you have received.

QBRA-2004: Vendors > Pay Bills

Double check that the ending balance in the clearing account is the amount of the profit. Like any Balance Sheet account, it is also possible to reconcile this account. The reconciliation procedures can be helpful in finding the problem if the balance is not the correct amount.

The final step will be to include the profit check amount on a deposit slip into the regular checking account. When it is entered, the “from account” will be the clearing account and the amount will be the amount received. The other columns are optional based on how detailed you would like to keep the QuickBooks records.

If the check was deposited alone, you also have the option to simply enter a line in the register for the amount of the profit to transfer it to the regular checking account. Either way will be acceptable from a general ledger standpoint.