16 Nov Ask the Expert – Statement Charges Aging

Ask the Expert – Statement Charges Aging

Q – My client has been entering statement charges rather than invoices then sends a statement at the end of each month. This has been working well, except that the statement charges always show as current, even when they are quite old. What are we doing wrong? Submitted by Sheila

A – Statement charges are often a quick way to enter amounts due from customers. Typically invoices are sent as work is completed, and 0″>statements are used when an invoice becomes past due. For some types of work, it is more efficient to enter statement charges directly into the customer register then send a statement regularly with the statement charge detail. This method is not recommended if selling taxable items, an invoice would be required for accurately calculating the amount of sales tax due.

With the statement, there is not the same level of customization as the invoice. For example, additional description lines without an item are not available; the subtotal type lines are also not available. For some businesses this is important, for others it is not.

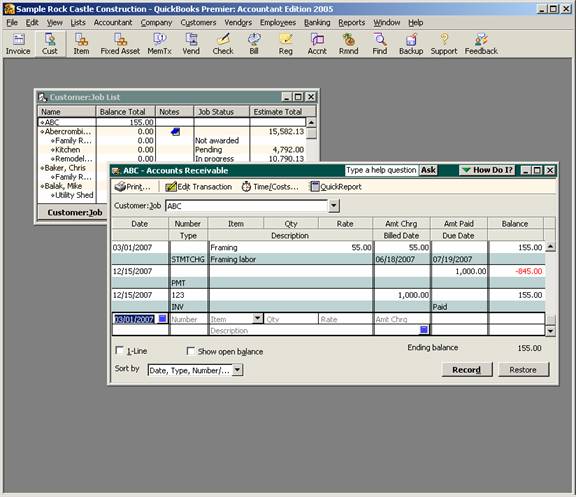

In this case, it sounds like a very common data entry error has occurred, not entering the due date. When entering a statement charge (basically a detail item line directly into the customer register) the flow of entering the information is straight forward. The date, the optional number, the item, the optional quantity and rate to arrive at the amount charged. At this point, most people record the transaction. However, the second line does permit customizing the description for the charge that will appear on the statement. And, more importantly, the due date. The due date is not mentioned in the help documentation and when using “tab” to navigate through the data entry the field is skipped, but it is possible to enter whatever due date is required. Note that the billed date does not appear on the statement.

The data entry into the Accounts Receivable register from the chart of accounts or the Customer:job register from the Customer list is the same.

QBRA-2005: Lists > Customer:job List > Single click on customer > Activities > Use Register