15 Nov Write off Over/Under Payment

Write off Over/Under Payment

With version 2005 there were many feature enhancements to the receive payment section of the program. Everything from preference changes to being able to find an invoice directly from the receive payment screen to being able to create a refund check for an overpayment immediately. Another enhancement is the ability write off an overpayment from the receive payment screen.

For prior versions, the discount feature could be used to write off small amounts but an invoice was required to write off the small overpayments. Version 2005 has simplified this process for small over payments. Under payments continue to use the discount feature.

As soon as the customer is entered in the received from field and the amount is entered a new box appears in the lower left hand side. When the amount is an overpayment, there are two choices: to leave the credit to be used later, or to refund the amount to the customer.

QBRA-2005: Customers > Receive Customer Payment > Enter Customer > Enter Amount less than amount due

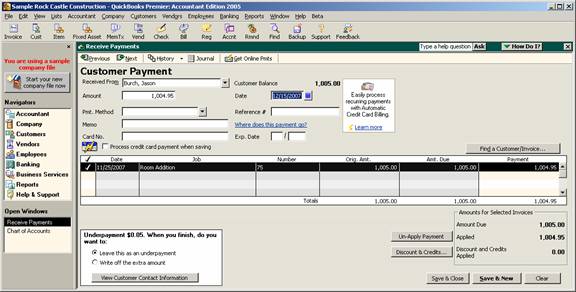

For example, if a customer has an outstanding balance of $1,005.00 and a payment is received in the amount of $1,004.95 the box in the lower left hand side will be:

Underpayment of $0.05. When you finish do you want to:

- Leave this as an underpayment

- Write off the extra amount

It is also possible to click on the button to view customer contact information (i.e. the edit customer screen) to be able to easily see the customer contact and phone number if a discussion with the client is needed, or access to the notes to see if there is some reason that has been documented on why they would have underpaid, etc)

If the first choice is correct, the underpayment will remain as an outstanding amount on that specific invoice. If the choice is to write off the extra amount, when the transaction is saved a pop up box will appear to choose the appropriate account from the chart of accounts. The most common accounts are either “Sales Returns and Allowances” or “Bad Debt.” The help function within QuickBooks suggests an expense type account called bad debt or write offs. Once the account (and class if class tracking has been turned on) has been chosen the first time, it will be the default the next time.

QBRA-2005: Customers > Receive Customer Payment > Enter Customer > Enter Amount less than amount due > Write off the extra amount