16 Nov Workers Compensation Code List

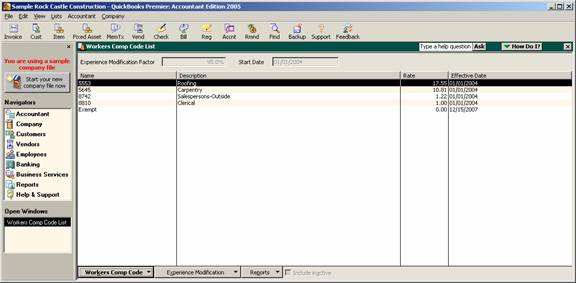

Workers Compensation Code List

New with version 2005 is a whole new group of features including the ability to set up and automatically calculate workers compensation payable amounts. This new feature is only available with Pro and higher for those businesses who subscribe to the Enhanced Payroll Service.

The process is three steps:

- Set the Workers Comp preference

- Create the code list

- Use the codes when creating paychecks

QBRA-2005: Lists > Workers Comp Code List

To set up the code is very straight forward. What is the code assigned by the workers compensation insurance carrier for the group of employees, what is the description of that code, what is the rate (make sure it is entered per $100 of payroll not as a percentage of what will be paid on the gross wages), and when to start using the rate.

QBRA-2005: Lists > Workers Comp Code List > Workers Comp Code > New

Once a code has been established, when it is subsequently edited two additional fields are available at the top of the screen: One for the new rate for the code and the other for the date that the rate will be effective.

QBRA-2005: Lists > Workers Comp Code List > Workers Comp Code > Edit

These codes can be entered into the employee set up screens, when time activity is entered, or directly with the create paycheck information.

The experience modification is provided by the insurance company. It is an adjustment to the rate based on the past claim history of the business. Most business start at 100% (i.e. the rate based on their employee job classification is what they will pay). If they have not had many claims relative to their insurance premiums, the modification may result in a lower insurance premium. A few big claims, can also make that experience modification factor result in higher premiums that the standard rate. As the experience modification changes over time, it can be adjusted from the Workers Comp Code List.

The rate should be entered as a number and it will be converted by the software to include the percentage. For example, a 95% experience modification should be entered as “95” and it will appear as “95.0%” when saved. Also enter the date. The software will use the new rate for paychecks with a pay date from the date entered forward.

TIP: If the date is in the past and payroll has already been calculated, the payable amount will not be retroactively changed. A payroll liability adjustment can be entered to correct any errors in the amount due via QuickBooks.

QBRA-2005: Lists > Workers Comp Code List > Experience Modification > Edit

TRICK: If an incorrect date is entered, there is no way to change that if it is a current date or prior. If a future date is entered, it will be saved via the edit experience modification factor window, but will not update until that date (i.e. the current rate still appears until the new rate takes effect).