17 Nov Workers Comp Calculations

Workers Comp Calculations

New with version 2005 it is possible to have the workers compensation premium payable automatically accrue as the paychecks are created. This process requires an upgraded tax table service from the standard (Do It Yourself) payroll to the Enhanced Payroll or Enhanced Payroll Plus for Accountants.

Once the workers comp code list has been set up, the preference has been confirmed, and the employee has been assigned, the next step is to actually calculate the paycheck.

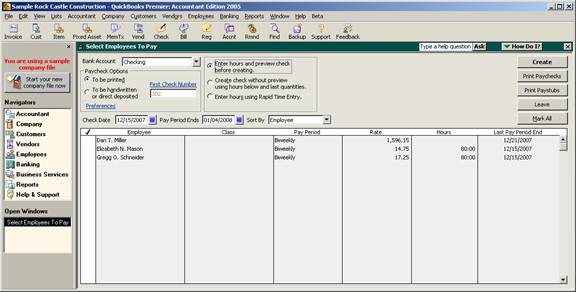

QBRA-2005: Employees > Pay Employees

The pay employee screen has been modified slightly to include a column for the workers comp code and for the calculation of the premium in the company summary section of the screen.

Trick: Be very careful of the new preference that permits the copy of the last paycheck earnings.

QBRA-2005: Employees > Pay Employees > Mark employees to be paid > Confirm check date > confirm period end date > Create

Once the payroll has been processed there is a variety of standard workers compensation reports available.