17 Nov Voiding a Check in Version 2006

One of the most publicized changes in QuickBooks version 2006 among accountants when it first came out was the change in voiding checks so the net effect is recorded in the current year. In fact, I have had a room full of Accountants actually cheer when they learned of this feature. While the theory is great, in practical application, there are some significant issues that need to be addressed.

Theory Overview

The voiding a check feature in QuickBooks, prior to version 2006, should only be used when the check is to be voided immediately. The reason is that the check is changed as of the original transaction date. If this date is in the past, historical results will be changed.

With version 2006, the original check is voided. A journal entry is created with the original transaction date to adjust the General Ledger to what it was then that entry is reversed with a current date to show the increase in the bank account in the appropriate period.

Reality of How It Works

The theory of this approach makes Accountants very happy because no longer will voiding a check change the historical reports, most importantly, Retained Earnings. Unfortunately, there are many limitations to how the process really works.

- Issue: Closed Period. This new process is only used by the software for voiding checks in a closed period. If there is not an appropriate closing date entered any checks will be voided using the same procedures as version 2005 and prior. To Do: It is critical that a closing date be entered and that it is updated as each period is reconciled and should be locked from future changes.

- Issue: Expense Only. This new process is only used by the software for checks that have been entered and coded to an expense account. Any transactions coded to a Balance Sheet account will be voided using the same procedures as version 2005 and prior.

- Issue: Check versus Bill Payment. This process is only used by the software for checks, not for bill payments. Bill payments are still handled using the same procedures as version 2005 and prior: The bill payment is voided as of the original transaction date with the result being the bills are again available to be paid.

Specific Examples to Illustrate What Happens

Set Closing Date:

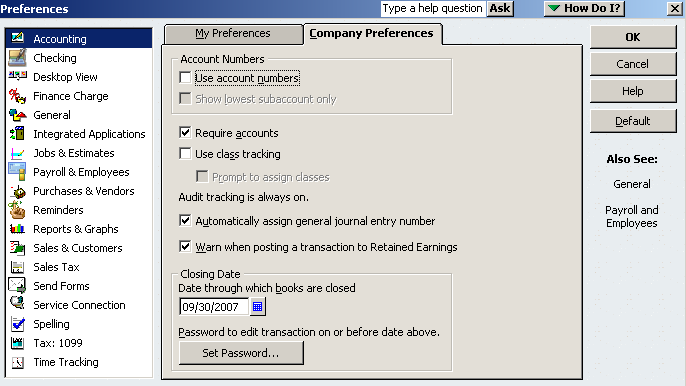

QBRA-2006: Edit > Preferences > Accounting > Company Preferences

For check coded to an expense prior to the closing date:

QBRA-2006: Lists > Chart of Accounts > Checking > Scroll to the top to view check 302

QBRA-2006: Lists > Chart of Accounts > Checking > Scroll to the top > Edit > Void Check > Record

QBRA-2006: Lists > Chart of Accounts > Checking > Scroll to the top > Edit > Void Check > Record > Yes

QBRA-2006: Lists > Chart of Accounts > Checking > Scroll to the top > Edit > Void Check > Record > Yes (to acknowledge closed period warning) > Scroll to current date for reversing entry

For Bill Payment in a Closed Period:

QBRA-2006: Lists > Chart of Accounts > Checking > Scroll to the top to view check 513

QBRA-2006: Lists > Chart of Accounts > Checking > Scroll to the top to view check 513 > Edit > Void

QBRA-2006: Lists > Chart of Accounts > Checking > Scroll to the top to view check 513 > Edit > Void > Yes (to acknowledge closed period warning) > Note that the check has been voided but the journal entry to correct the General Ledger is not created

Our Opinion

While there are features in the new version we love from an accounting perspective such as the change to the audit trail of always on and the ability to toggle to the other editions, our