17 Nov Vendor Refunds

Vendor Refunds

Depending on how the original payment was made will dictate how the refund will need to be recorded.

A) If the bill/bill payment method was used, the vendor should currently show an overpayment on the account. To record the return of the overpayment, the amount will be entered on a deposit slip with the vendor name and coded to Accounts Payable.

B) If the amount was originally paid with the write check method, the deposit will still be recorded on a deposit slip. The change will be that the code should be to the same account as the original overpayment. The two amounts will then “net” leaving the remaining true expenditure balance.

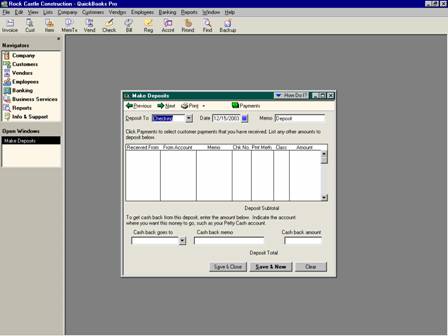

QBRA-2003: Banking > Make Deposits

Return of an item – First enter a credit for the item(s) to be returned by placing the mark next to credit at the top of the bill form and complete the bottom of the form based on the details of what was returned. Typically this will be the same information as the original transaction. Then enter the refund as detailed in part A above.

Return other than items – If the return was for something other than an item, part B above will provide the steps necessary to correctly record the refund.

QBRA-2003: Vendors > Enter Bills