17 Nov Vendor Discounts

Vendor Discounts

An important part of cash flow management for many small businesses is to take advantage of the discounts offered by suppliers for prompt payment. The discount feature, in conjunction with assigning the terms to the bills, will help to automate this process.

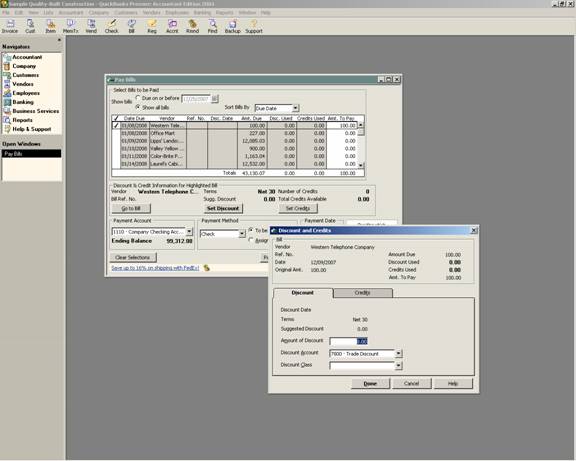

When the terms are set to include a discount, clicking on the set discounts button when paying bills will automatically fill in the “Amount of Discount” box. That amount can be changed if it is not the amount that should be taken (for example, discount only applies to products not to freight).

QBRA-2004: Vendors > Pay Bills > Single click on a bill > Set Discounts

TRICK: When paying bills, the bills by default will appear that are due on or before the date entered (typically 10 days from the current date). If an invoice is 1% 10 days, net 30 for example, it will not appear on the pay bills screen when it is eligible for the discount. If discounts are common for the business, the recommendation is that the “show all bills” radial button be marked and then sort the bills by discount date to eliminate the potential for lost discounts.

TRICK: In versions 2002 and prior, there is not a place to assign the class when taking a discount. It may be preferable to enter a credit for the amount of the discount so that the amount can be assigned to a customer:job and/or class as appropriate. The only other way to correct the reports (i.e. move the amount from unclassified to the appropriate class) is to do a journal entry. The debit and credit will be for the same amount and coded to the same account (net effect zero) but the debit will need to have the class column blank and the credit will need the class.