17 Nov Using Business Credit Cards

Using Business Credit Cards

Revolving debt is a way of life for many small businesses. This additional leverage permits growth that would not otherwise be possible. Keeping track of the balances and related charges can be a challenge. Although QuickBooks has Accounts Payable features that could be used, typically using the feature specifically designed for entering and reconciling credit card charges from paying for goods and services is much more efficient. The reasons include:

- · A reconciliation process that includes balancing QuickBooks to the statement from the credit card company and automatically generating a check or bill to pay all or a portion of amount due.

- · Accounts Payable agings and due dates are distorted when the entire balance is not paid in full.

- · Credit card charges are typically deductible for income tax purposes whether the credit card company has been paid or not. When creating reports on the cash basis Accounts Payable transactions coded to Profit and Loss accounts will automatically reverse.

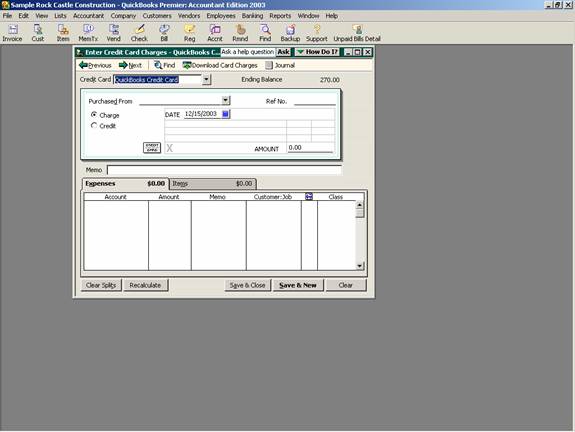

QBRA-2003: Banking > Record Credit Card Charges > Enter Credit Card Charges

The first step in using the credit card feature is to enter the charges and credit as the credit card is used to pay for the purchase of goods and services.

Note: Many credit card companies also have the credit card statements available in a downloadable format that may be able to be imported into QuickBooks. In fact QuickBooks even has its own credit card that clients can apply for.

When the statement arrives, it should be reconciled. This process is very similar to the bank account reconciliation process.

QBRA-2003: Banking > Reconcile Credit Card

The main difference is at the end of the reconciliation process once the “Reconcile Now” button has been clicked, a screen will appear to provide an alternative to enter a check to pay the credit card now or a bill to pay the credit card later. Either choice is acceptable. The most important decision to make is the amount that will be paid. By default the amount is to pay the balance in full. The amount should be overridden based on what will be paid to permit reconciliation with the next statement.