16 Nov Receiving Payments from Customers

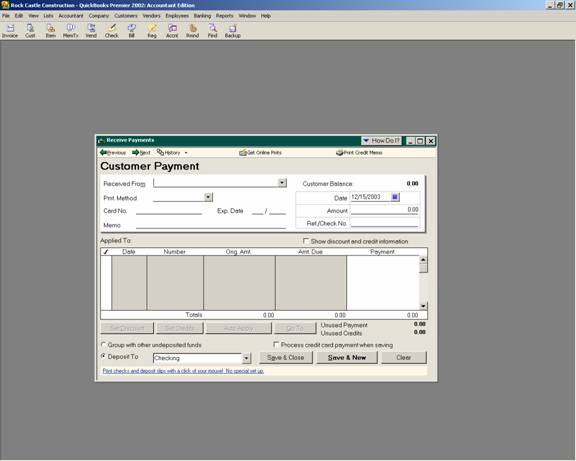

. If cash or check is chosen, the additional credit card fields will not be visible.

Memo – The information entered in this field will appear on reports and on the statement.

TIP: There is not a report within QuickBooks that will display the specific invoices and credit memos that have been used to reconcile with the payment received. For this reason, the memo field is often an effective way to document this information when the invoice or credit memo numbers are entered.

Applied to – the sales & customer preference controls if QuickBooks will apply payments automatically (first if the amount matches a specific invoice amount, if not, to the oldest invoice first). If not, the user must choose the specific invoices to be used. With either choice, credit memos and discounts must be applied manually. The amounts can be applied in total by placing a check mark in the far left column, or partial payments can be received by typing the specific amount in the payment column to the right.

There are two choices for how the “applied to” detail area will be displayed.

- 1. Date, job (if applicable), number, original amount, amount due, and payment; or

- 2. Date, job (if applicable), number, original amount, discount date, amount due, discount, credits, and payment.

QBRA-2004: Customers > Receive payments > Show discount and credit information

Set Discount – If the terms list was used when the invoice was created, by clicking on the set discount button, the calculated amount of the discount will be automatically filled in. It is possible to override or enter an amount as well as designate the general ledger account that should be used when recording the discount.

Set Credits – Credit can include credit memos as well as previously unapplied payments. A change with version 2002 and higher is the ability to apply credit memos to specific invoices. In previous versions there is a box to check to apply credit memos to the outstanding invoices. In 2002 and higher the invoice must be chosen, and then it is possible to set discounts or set credits.

Group with other undeposited funds – Undeposited funds is a special QuickBooks account which is used to accumulate payments from various customers: jobs. The payments that have been received are then reclassified from undeposited funds into the bank account by way of a deposit slip when the money goes to the bank. This procedure will match the deposit total with bank statement.

Deposit to – This is the alternative if deposit slips are not going to be printed and each payment is deposited into the bank account individually as it is received.

TIP: If the amounts applied to specific invoices does not match how the customer has noted the payments have been made, click on “clear selections” or manually uncheck the invoices that do not have the correct amounts paid. It is possible to then either place a check mark in the appropriate column to show the invoice paid in full, or, type in the amount paid in the right hand payment column.