16 Nov Making Deposits from Customer Payments

Making Deposits from Customer Payments

The make deposit function is for depositing various checks received from customers and coded to undeposited funds. It is also used for recording other deposits of miscellaneous amounts received from sources other than customers, such as loan proceeds, rebates, etc. The latter can be added to a deposit slip that has been created from undeposited funds.

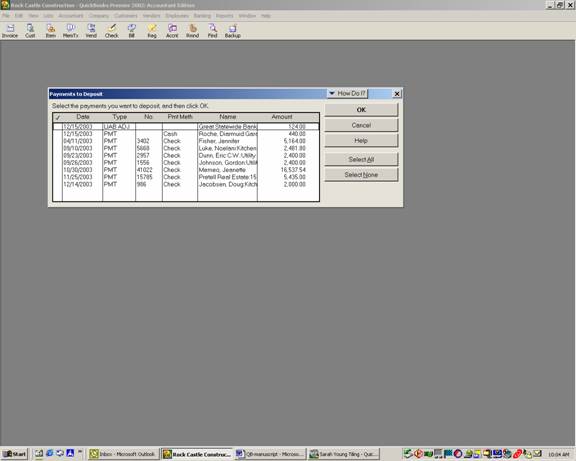

QBRA-2003: Banking > Make Deposit (Note: this screen will not appear if there are not any payments that have been entered through undeposited funds. Place a check mark next to all the payments that will be deposited together then click on OK.)

TIP: As an internal control procedure, print the deposit slip and attach the bank receipt. This also makes investigation of any bank discrepancies much easier.

New with Version 99, QuickBooks added the ability to print the deposit slip on preprinted forms. At the top of the form is the deposit slip with the preprinted bank information and a deposit summary is on the bottom for your records. To use the form, enter the deposit as usual. The change is that when you print, you have two options:

q Deposit slip and deposit summary

q Deposit summary only

The bottom option is the same as in previous versions.

QBRA-2003: Banking > Make Deposit > Place a check mark next to all the payments that will be deposited together > OK > the payments will appear in the format below.

Confirm the bank account and deposit date are correct. It is also possible to enter additional money to be deposited or cash back directly onto the form as needed.