16 Nov Ask the Expert – Quick Assets and Accounts Receivable

Ask the Expert – Quick Assets and Accounts Receivable

Q – How can I place A/R collections into an account that appears in “Bank” category but still give me the flexibility of marking specific entries. The result would transfer an amount equal to the actual bank deposit? “Other Current Assets” is not the same as “Quick Assets” (the equivalent of “Cash on Hand”).

Submitted by Len.

A – What you are describing is the function of “undeposited funds,” a specially created account in QuickBooks which serves as a “cash on hand” clearing account so that as money is received from customers, it is recorded into this account, then as that money is deposited into the bank it is transferred out. If good cash flow and internal control procedures are followed, this is a temporary account and at the end of each day the balance should be zero. This means at the end of each day the “Quick Assets” calculation will be accurate.

Note: With 2005 there is now a preferenceto always default to undeposited funds when receiving payments.

The challenge will arise if the money that is received is not deposited in the bank account prior to the ratio calculation. In this case, it is possible to create a journal entry to reclassify the balance and then reverse the entry the following day.

The only way that the method you are describing, i.e. creating a “Cash on Hand” bank account would be to record money as it received into the account, enter a transfer type entry to move the amount from the “Cash on Hand” to the bank account, and then reconcile the “Cash on Hand” account. This reconciliation process would have a beginning and ending balance of zero, the result will be the ability to report on “cleared’ (i.e. deposited) and “uncleared” (i.e. not yet deposited) amounts.

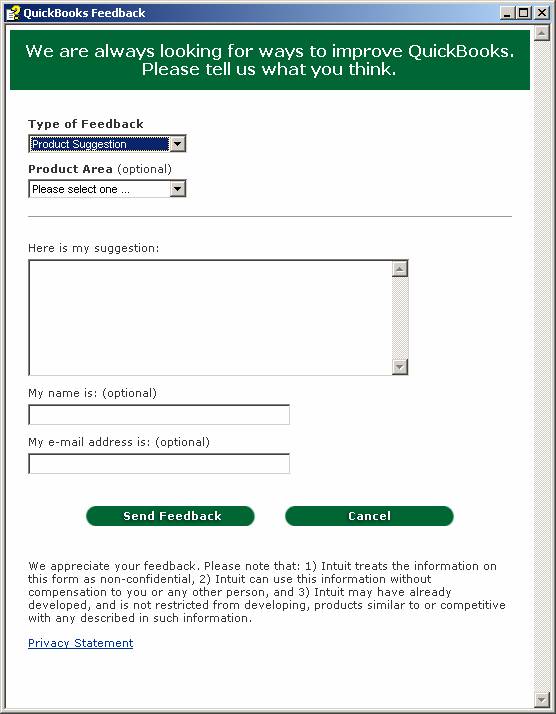

Follow Up Suggestion: Undeposited Funds is created as an “Other Current Asset” and there is no way to change that type. This has always been a source of frustration for me since, as you alluded to, it is really a cash account. The situation is further complicated by the fact that the Undeposited Funds account is included as cash when creating a Statement of Cash Flows. This mismatched treatment of the account is confusing. So, here is the suggestion, the best way to communicate with Intuit regarding changes you would like to see in the software is to click on help within QuickBooks and then send feedback online. Please consider doing that for this issue.

Help > Submit Feedback Online > Submit Product Suggestion