17 Nov Timesheet Overview

Timesheet Overview

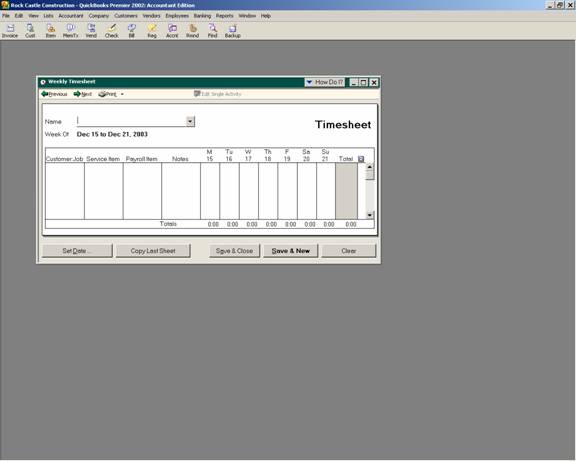

Timesheets are a “Pro Only” and higher feature for tracking employee time by the day, job, task, etc. Timesheets are not required to process payroll. Time can be entered in total when the paycheck is created. To turn on the timesheet feature, choose: Edit > Preferences > Time Tracking > Company Preferences. The only two questions are: Do you track time, and what is the first day of the week?

The timesheet, like most of the forms in QuickBooks is very intuitive. The form looks like one that could be completed on paper. Time information can be entered for any employee, vendor, or other name. This information is then available to create a paycheck for the employee, create a check or bill for a sub-contractor, or issue an invoice to a customer.

Timesheets, like estimates or purchase orders, are non-posting. There is no effect on the general ledger until the time has actually been paid or invoiced. In addition, reports can be generated from the time that has been entered, but it will not have an extended dollar amount associated with it (i.e. for WIP, vacation accruals, etc.).

QBRA-2003: Employees > Time Tracking > Use Weekly Timesheet

TRICK: An add-on product is now available to combine any unbilled costs, items, and time (extended based on the selling price of the item) for a Work In Process report or for easy review and approval prior to invoicing.

If longer notes are needed, it may be more efficient to use the “Enter Single Activity” window for data entry and the weekly timesheet to double check the accuracy of the information that has been entered. In Version 2004 the notes fields will wrap so the entire text can be viewed on the screen.

To use the timesheets to calculate payroll, the time entered will be automatically “pulled” onto the create paycheck screen. If it does not appear, confirm that the box has been checked when the employee was set up to pay from time data. That option is in the middle of the employee payroll info tab.

TIP: If the class feature is not present on the time sheet, choose Edit > Preferences > Payroll & Employees > Company Preference > assign one class per earnings items.

TRICK: The timesheet data will convert to a bill or check for owners or subcontractors beginning with version 2002. For Versions 2001 and prior, however, only the option to create a check from a timesheet is available.

TIP: Just like timesheets for employees, the software does not create any job costing expenses in the general ledger until payment is actually made from the timesheet.

TRICK: When the time data is used to create customer invoices, the sales rate charged to the customer is based on the amount entered for the item. New with version 2001 and higher, there is a price list option to permit automatic calculations as a percentage increase or decrease to what is charged to the customer. This will handle the issue of different rates for the same type of work based on different customers. To charge different rates for the same type of work completed by different employees will still require different items.

TIP: Notice that only service items from the item list can be used on a time sheet (i.e. not other charge, non-inventory part, etc).