16 Nov Time/Cost Button in Pro and Premier (Expense Button in Basic)

Time/Cost Button in Pro and Premier (Expense Button in Basic)

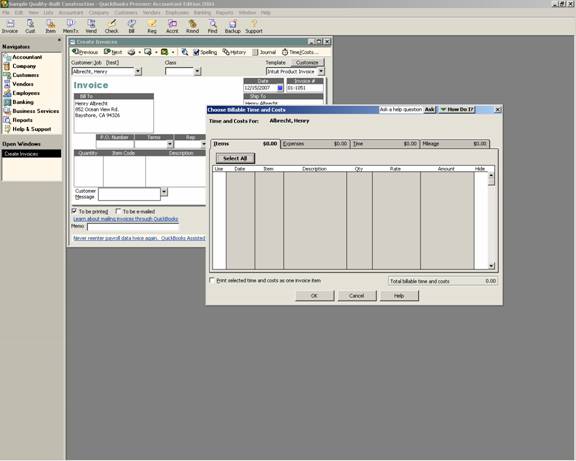

If time tracking is used and items or other expenditures are assigned to a customer:job it is possible to click on the Time/Costs button to invoice for amounts charged to the specific customer:job. This process will automatically change the amounts from billable to billed. If the invoice is subsequently delete, it does not change the status back from billed to billable. Creating an invoice for expenses is the only option with QuickBooks Basic.

There are many reports available to review the time, costs, and items that are billable prior to invoicing. The reports used to view the amounts to be invoiced prior to actually creating the invoice can be found as follows:

Reports > Customers & Receivables > Unbilled Costs by Job (this report includes both expenses tab entries and items)

Reports > Jobs & Time > Time by Job (this report can be created in summary or detail)

QBRA-2004: Customer > Create Invoice > Choose Customer:Job > Time/Costs Button

Items Tab – The item description and selling price that will be used is based on the sales side of the item, or, in the case of an item not using the advanced job costing features, the only description that was entered. If no selling price has been entered, the cost will be used based on the purchase transaction. The price level, if any, will not be applied to transactions entered in this way.

Expenses Tab – It is possible to enter a mark up percent and account to be used to increase the selling price above cost. The description used will be the memo from the disbursement transaction. There will not be an item associated with the transaction. The amount will be coded as a reduction to the expense, or as reimbursed expense income as dictated by the Sales & Customer preference.

QBRA-2004: Customer > Create Invoice > Choose Customer:Job > Time/Costs Button > Expenses Tab

Time Tab – The time from a timesheet can be transferred as individual entries or like items totaled together. Three choices for the description exist if transferring the time in detail: the item description (as entered on the item list); the memo (as entered on the time sheet); or both. The latter choice was new with version 2003 and higher. If the items are transferred to an invoice in total, the item description will be used. The price level, if any, will be applied to transactions entered in this way.

QBRA-2004: Customer > Create Invoice > Choose Customer:Job > Time/Costs Button > Time Tab > Options

For versions 2002 and prior, the ability to control the description from the time sheet or from the item list was by clicking the “change” button.

QBRA-2002: Customer > Create Invoice > Choose Customer:Job > Time/Costs Button > Time Tab > Change

TIP: When creating an invoice, there is also the ability time/cost information print in detail on the invoice, or show the detail on the screen but print as only one line when the appropriate box is checked.

TIP: All of the sales prices can be adjusted on the invoice itself if necessary.

TRICK: There is not a report that will show unbilled time based on dollars that will be invoiced, only on hours. There is not a report that shows the total amount that will be invoiced to the customer including time and costs. There is, however, an Excel Add In that fills this need. For more information, learn about WIP Reports.