16 Nov Statement Charges

Statement Charges

Statement Charges are a way to enter amounts due that appear directly on the statement and customer balance reports without creating an invoice or credit memo. This is appropriate if statements only are sent (i.e. there is no need to send an invoice to the customer as charges are incurred) and sales tax does not need to be charged on the item.

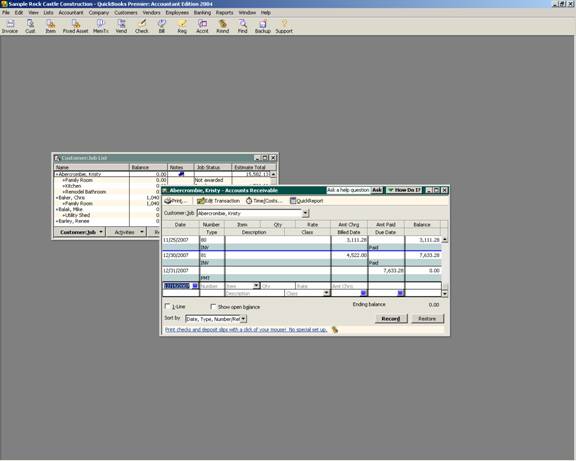

To enter statement charges, they are input directly into the customer:job register. An item is still required. It is possible to modify the description and to assign the item to a specific class.

TIP: It is possible to get to the register from the customer:job list by double clicking on the customer:job or by clicking on Activities at the bottom of the list then use register.

QBRA-2004: Customer > Enter Statement Charges > Choose appropriate customer from pull down list at top of the register