15 Nov State Payroll Tax Forms

State Payroll Tax Forms

New with version 2005 Enhanced Payroll is the ability to print many of the state forms. To see specifically which states and which forms are supported at the present time, visit http://www.quickbooks.com/taxforms/index.html select a state and view the list of the forms supported for that state. Scroll down to see the availability as it is as of 10-30-04 on this page.

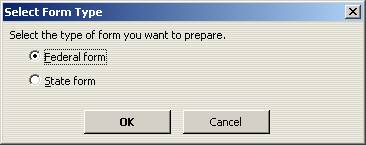

To use the feature, sign up for the Enhanced Payroll, process the payroll as usual, then choose the state option from the payroll forms window.

QBRA-2005: Employees > Process Payroll Forms

The next screen is to select a state form and filing period

QBRA-2005: Employees > Process Payroll Forms > State form > OK

If there is missing information, a warning pop up box will appear:

The next screen provides an explanation as to why the form does not look like the one from the payroll agency.

The next step is to proceed to the form itself. Review for accuracy (right click to override any incorrect information, and be sure to go back to QuickBooks and correct the information for the future). It is possible to check the form to make sure there are no errors, or click on Next to see the actual form on the screen. Next again will show the Filing and Printing Instructions on the screen (or choose from that option at the bottom of the form) and then print the form or save as PDF.

To change the printer, choose Set Up, otherwise, if everything appears correct, click print.

Note: If Intuit was waiting for the approval of the form from the payroll agency when printing the form it will have a “Do Not Print” watermark. The information can be transferred to the actual form provided by the governmental agency if the approval is not received by the time the filing is required.

After the form has been printed there is a pop up reminder to make any changes in QuickBooks directly that might have been made on the form itself.

All Supported Forms as of 10-30-04:

|

|

State |

|

Form |

|

Name |

|

|

|||||

|

|

AL |

|

Form A-1 |

|

Employer”s Quarterly Return of Income Tax Withheld |

|

|

|||||

|

|

AL |

|

Form A-3 |

|

Annual Reconciliation of ALA Income Tax Withheld |

|

|

|||||

|

|

AL |

|

UC-CR4 |

|

Quarterly Contribution & Wage Report |

|

|

|||||

|

|

AK |

|

TQ01C |

|

Quarterly Contribution Report |

|

|

|||||

|

|

AZ |

|

A1-QRT |

|

Quarterly Withholding Tax Return |

|

|

|||||

|

|

AZ |

|

UC-018 |

|

Unemployment Tax and Wage Report |

|

|

|||||

|

|

AR |

|

AR3MAR |

|

Employer”s Annual Reconciliation Of Income Tax Withheld |

|

|

|||||

|

|

CA |

|

DE6 |

|

Quarterly Wage and Withholding Report |

|

|

|||||

|

|

CA |

|

DE7 |

|

Annual Reconciliation Statement |

|

|

|||||

|

|

CA |

|

DE88 |

|

Payroll Tax Deposit |

|

|

|||||

|

|

CT |

|

CT-941 (DRS) |

|

Quarterly Reconciliation of Withholding |

|

|

|||||

|

|

CT |

|

UC-2 |

|

Employer Contribution Return |

|

|

|||||

|

|

CT |

|

CT-W3 (DRS) |

|

Annual Reconciliation of Withholding |

|

|

|||||

|

|

DC |

|

DOES-UC30H |

|

Employer”s Annual Contribution and Wage Report |

|

|

|||||

|

|

DC |

|

DOES-UC30 |

|

Employer”s Quarterly Contribution and Wage Report |

|

|

|||||

|

|

FL |

|

UCT-6 |

|

Employer”s Quarterly Report |

|

|

|||||

|

|

GA |

|

DOL-4 Part I (Also known as DOL-4N) |

|

Employer”s Quarterly Tax and Wage Report |

|

|

|||||

|

|

GA |

|

G-7/Sch B |

|

Quarterly Return for Semi-Weekly Payer |

|

|

|||||

|

|

GA |

|

G-7 |

|

Quarterly Return for Monthly Payer |

|

|

|||||

|

|

GA |

|

G-7 |

|

Quarterly Return for Quarterly Payer |

|

|

|||||

|

|

GA |

|

GA-V |

|

Withholding Payment Voucher |

|

|

|||||

|

|

GA |

|

G-1003 |

|

Income Statement Transmittal |

|

|

|||||

|

|

ID |

|

TAX020 |

|

Idaho Employer Quarterly UI Tax Report |

|

|

|||||

|

|

IL |

|

IL-501 |

|

Illinois Withholding Income Tax Payment |

|

|

|||||

|

|

IL |

|

IL-941 |

|

Illinois Quarterly Withholding Income Tax Return |

|

|

|||||

|

|

IL |

|

UI-3/40 |

|

Employer”s Contribution and Wage Report |

|

|

|||||

|

|

IL |

|

IL-W-3 |

|

Illinois Annual Withholding Income Tax Return |

|

|

|||||

|

|

IN |

|

WH-3 |

|

Annual Withholding Tax |

|

|

|||||

|

|

IA |

|

44-007 |

|

Annual Withholding Agent Verified Summary of Payments |

|

|

|||||

|

|

IA |

|

44-095a |

|

Withholding Quarterly Return |

|

|

|||||

|

|

IA |

|

65-5300 |

|

Employer”s Contribution and Payroll Report |

|

|

|||||

|

|

KS |

|

K-CNS 1001 |

|

Quarterly Wage Report and Unemployment Tax Return |

|

|

|||||

|

|

KY |

|

UI-3 |

|

Employer”s Quarterly Unemployment Wage and Tax Report |

|

|

|||||

|

|

KY |

|

42A806 |

|

Transmitter Report for Filing Kentucky Wage Statements |

|

|

|||||

|

|

KY |

|

K-3 |

|

Employer”s Return of Income Tax Withheld |

|

|

|||||

|

|

LA |

|

LDOL-ES4 |

|

Quarterly Report of Wages Paid |

|

|

|||||

|

|

LA |

|

L-3 |

|

Annual Income Tax Withholding Reconciliation |

|

|

|||||

|

|

ME |

<=””> | |||