23 Nov Software/Publication Inventory Case Study

Software/Publication Inventory Case Study

Situation:

- The company would like to use the inventory module to track the # of product in stock

- Some stock is given away for PR purposes and the company wants to show that expense separate than cost of goods sold (i.e. COGS) on the financial statements

- They would like to segregate revenue between new sales and update sales.

4 issues to consider

Before determining the best solution there are several issues to consider:

- Is the class feature being used for anything else or is this a reasonable way to track the new versus update sales?

- How is the product purchased? Is it manufactured by someone else and purchased as a finished good, or are there development and production costs that need to be paid individually and then combined to arrive at the total cost for the product?

- What is the accounting knowledge and QuickBooks familiarity of the person who will be responsible for the recordkeeping?

- When the product is received, can a reasonable guess be made as to how much of the product will be for the three types of use: sales, updates, or PR?

Using the Class Feature

The class feature is an easy way to segregate the revenue between the new and update sales. By using the Profit & Loss by Class the revenue and related COGS will show in a column for each type of sale making the determination of the gross margin much easier. It also eliminates the issue to tracking the inventory between the numbers of product for each type of sale.

How is the product purchased?

Once the items are entered, inventory will be relieved by entering the sales receipt or invoice. For the PR items, it is critical that the shipments be recorded even though the selling price will be zero.

Scenario 1: Purchased as finished goods

This is the easiest scenario because the total cost of the product is known when it is received.

Assuming the class feature is a viable alternative for the new versus upgrade sales, two inventory items will need to be set up: one for the product that will be sold; and one for the product that will be used for promotional purposes. If it is not, there will be an additional item for the upgrade sales.

Enter the quantity and cost on the item tab of a bill, check or credit card charge and the inventory will be recorded for each of the inventory items used. This is assuming that a reasonable guess can be made as to the quantity to be used for each of the different items. If that is not true, see the work around below for when the quantity is not known.

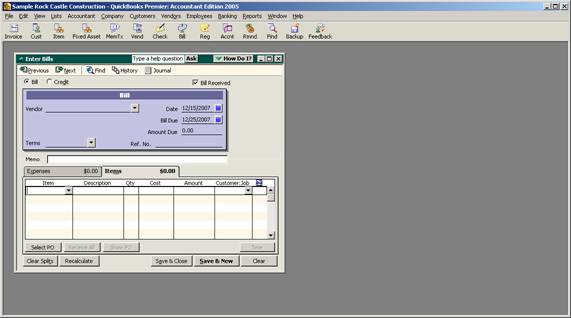

QBRA-2005: Banking > Enter Bills > Item Tab

Scenario 2: Development and production costs need to be combined to arrive at the cost

With this scenario, there are two alternatives:

- The easiest way to accumulate the cost is to create a new other current asset type account to use as each component is paid. The name of this account can be “Inventory WIP” or anything else that is descriptive of what is it used for. This account can be used on the expense tab, or it can be used to create a non-inventory type part for use on the items tab of a check, bill, or credit card charge. Once all costs have been entered into this account, one entry can be made to reclassify the quantity and average cost for the inventory item by entering the inventory items with the respective quantity and cost on the items tab and the Inventory WIP account entered as a negative amount on the expense tab so the transaction has a net impact of zero.

- Depending on the version (Premier 2003 or higher is required) and if the component can be used in several ways (for example CDs are purchased in bulk but can be used for burning different software products so it will be important to keep track of the inventory of “blank” CDs as well as those used in the final product) inventory assembly type items may make the most sense. The individual components are purchased using the method described above then when the final product is created an inventory assembly build is required.

Alternative: The inventory assembly build method can also be used to receive all the finished goods as in scenario 1 above as an inventory item, and then the build would only be used as it needs to be transferred to a sale or PR type item.

What is the accounting knowledge and QuickBooks familiarity of the person who will be responsible for the recordkeeping?

There are many different ways to accomplish the same end result in QuickBooks. The options we are describing here are based on what has been easiest for the majority of the clients. If the client is comfortable with journal entries, inventory adjustments, etc there are other alternatives as well. The most important aspect of deciding on the procedures is to look at how the user enters information and choose an alternative that will accomplish accurate recordkeeping while making sense (and therefore will be remembered) to the user. Written procedures will also be critical to permit cross training and consistent data entry.

When the product is received, can a reasonable guess be made how much will be used for each item?

Scenario 1: Yes

This is the easiest alternative. When the product is received and entered using the procedures described above, the amount to be allocated to each item type (i.e. sales or PR) is entered at that time.

Note: If a subsequent adjustment needs to be made to reclassify inventory from one item to another, follow the procedures detailed for “No” below.

Scenario 2: No

This alternative requires more on-going management. Because QuickBooks uses average cost, it is critical that the items be transferred to the correct item prior to entering the sales receipt or invoice to relieve the inventory. The easiest way to manage this is to make sure the inventory warning preference is turned on.

QBRA-2005: Edit > Preferences > Purchases & Vendors > Company Preferences

Then, enter the product as purchase using a best guess as to the distribution. When a sales receipt or invoice is entered that exceeds the quantity available, do not save the transaction, but first enter a transaction to transfer from one item to another. The easiest way to accomplish this is to enter a bill or check for a zero amount and on the item tab enter the item that will be transferred from with a negative quantity and the correct average cost, and the item the will be transferred to with a positive quantity and the correct average cost. This will reduce one and increase the other. Once that transaction is saved, go back and save the sales receipt or invoice.