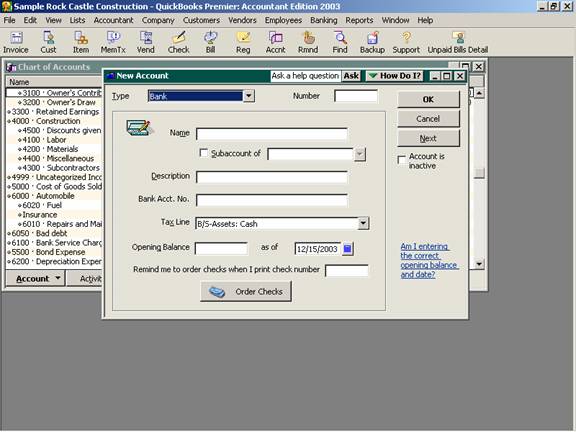

16 Nov Setting Up New Account

Setup a New Account

Assign an Account Type

To set up a new account, start by assigning the appropriate account type to the account. The chart of accounts is divided into various types of accounts that then create the highest level of subtotals for the financial reports based on the account type the account will automatically be “mapped” to the Balance Sheet or Profit and Loss. The standard choices on the list cannot be modified. Below is a list of the account type choices:

· Bank – used for checking, savings, or other liquid investments

· Accounts Receivable – at least one account of this type is required to use the Accounts Receivable features. Most small businesses only have one account of this type. An exception would be if various locations or different types of receivables (i.e. trade, installments, etc.)

· Other Current Asset – typical accounts in this section are inventory, prepaid expenses, other receivables, etc.

· Fixed Asset – property owned by the business such as equipment, machinery, computers, furniture, vehicles, etc. and purchases made by the business with a useful life in excess of one year, such as leasehold improvements. There is usually an Accumulated Depreciation and/or Accumulated Amortization account in this section as well.

· Other Asset – long-term assets such as long term investments, organizational costs, goodwill, cash surrender value of life insurance, etc.

· Accounts Payable – at least one account of this type is required to use the Accounts Payable features. Most small businesses only have one account of this type. An exception would be if various locations or different types of payables.

· Credit Card – this type account permits the reconciliation of running credit card balances as well as use of the credit card charge and credit features.

· Other Current Liability – the accounts in this section will be paid within a year. Some examples include current portion of long-term debt, customer deposits, profit sharing payable, garnishment payables, etc.

· Long Term Liability – these accounts will be paid in more than a year. Long-term portion of loans are usually the main component of this section.

· Equity – depending on the legal structure of the business, this may include accounts such as owner’s equity and draws; common stock and retained earnings; partner capital accounts; etc.

· Income – revenue generated from the main purpose of the business (usually the sale of the product or service)

· Cost of Goods Sold – expenses directly related to the generation of income (usually the purchase of the product sold)

· Expense – other expenses in the normal course of business (including insurance, taxes, overhead, advertising, office supplies, telephone, etc.)

· Other Income – revenue generated from a source other than the typical type of business (i.e. sale of a fixed asset, interest income, etc.)

· Other Expense – expenses not part of the normal course of business (theft, sale of fixed assets, etc.)

TRICK: Any transaction coded to an Accounts Receivable type accountwill require a customer. Any transaction coded to an Accounts Payable type account will require a vendor. Any transaction can only have one A/R or A/P type account, including journal entries. If QuickBooks is being used as a write-up program, A/R and A/P type accounts will be entered in total, choose the other current asset and other current liability types instead.

Assign a name, sub-account and description for the account

The name can be anything that adequately describes the activity to be included in the account. Typically the name is general enough to to make sense even if the vendor is providing the goods or services changes. For example, telephone expense is a common name whereas AT&T is not.

Check the box if this new account will be a sub-account of an already existing account. A sub-account is the method of creating detailed accounts that can be collapsed into a main account for reporting in summary, or expanded to show detail. An example would be telephone. It is acceptable to have one telephone account, or, if this is a large expenditure, the business owner may prefer to see more detail. This detail could be categorized into sub-accounts for cellular, long distance, local, and the like. If sub accounts have been established and a transaction is inadvertently coded to the main account, it will show on the reports as account name-other (i.e., in our example Telephone-Other).

For most QuickBooks users the description field can be left blank. The only time it becomes important is if the description and or name and description option is chosen in the reports preference.

Assign a bank account number

This option is available for bank type account sonly. Entering the bank account number provides an easy reference when the number is needed but is not necessary.

QBRA-2003: Lists > Chart of Accounts > Account > New

Assign the Tax Line

If QuickBooks will interface with another program (Turbo Tax for example) for tax return preparation, this information will be important. For most users, this field is optional.

TRICK: If the tax line is missing, it is because there was no tax form chosen when the QuickBooks file was set up. To change this set up option, choose Company > Company Information.