16 Nov Sales Tax

Sales Tax

Sales Tax is a challenging area for most businesses. The “rules” change from industry to industry and from state to state. For compliance, an accounting professional should be contacted for a complete understanding of all the rules that must be followed. In an effort to help manage the requirements, there are Company Preferences that can be set in QuickBooks. There are not any My Preferences for this feature.

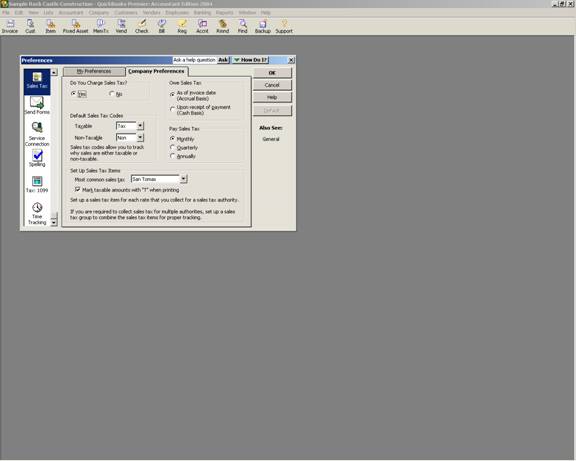

QBRA-2004: Edit > Preferences > Sales Tax > Company Preference

Do You Charge Sales Tax?

Typically most products sold at retail will require sales tax to be charged to the customer and then remitted to the state. Depending on the industry, some services may also be subject to sales tax. For the most up to date information, contact the state agency that is responsible for collecting sales tax. In California, for example, this is the State Board of Equalization (http://www.boe.ca.gov/) and a pamphlet is available for most types of goods and services sold within the state.

Default Sales Tax Codes

Version 2002 greatly enhanced the sales tax options with QuickBooks. The addition of sales tax codes to designate why an item was subject to sales tax or not as well as the ability to drill down on all the sales tax report columns were included in that and future versions.

Set Up Sales Tax Items

The most common sales tax item will be used when creating a new customer:job. As the default, it can be changed as appropriate.

Marking the taxable items with a “T” makes review of the invoices easier and the taxable status of individual invoice lines clearer for the customer.

Owe Sales Tax

As of invoice date is most common. When an item is sold, the sales tax charged is immediately due and payable at that time. Although most businesses would prefer to wait until they actually receive the payment, most tax authorities disagree, even if for income tax purposes the business is cash basis. If unsure, consult with an accounting professional or the sales tax agency for the state. If not done correctly, in the case of an audit the unpaid sales tax could be subject to penalties and interest for late payment. In California, for example, the sales tax is due as of invoice date unless a written waiver has been obtained from the State Board of Equalization.

Pay Sales Tax

By setting the preference that controls the frequency for the sales tax payment, the “Pay Sales Tax” window will have an appropriate date range by default.