17 Nov Sales Tax Revenue Summary Report

Sales Tax Revenue Summary Report

The Sales Tax Revenue Summary report uses the sales tax code list for the columns and the sales tax type items for the rows. The result is a report that shows the allocation for the total sales.

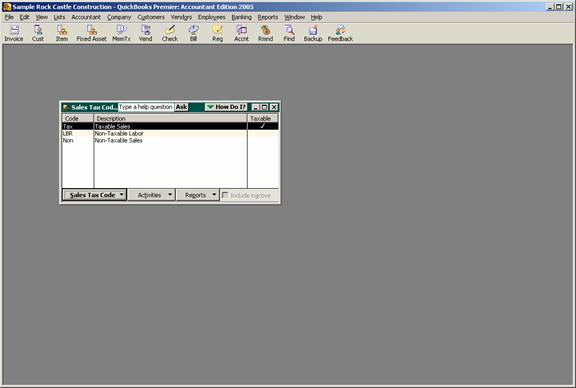

QBRA-2005: Lists > Sales Tax Code List

QBRA-2005: Reports > Vendors & Payables > Sales Tax Revenue Summary

QBRA-2005: Reports > Vendors & Payables > Sales Tax Liability

To make the Sales Tax Revenue Summary report more useful, consider filtering the report for only the non-taxable codes. This will provide a report that agrees in total to the non-taxable sales column on the Sales Tax Liability report.

QBRA-2005: Reports > Vendors & Payables > Sales Tax Revenue Summary > Modify Report > Filters Tab > Sales Tax Code > Change to All non-taxable codes

QBRA-2005: Reports > Vendors & Payables > Sales Tax Revenue Summary > Modify Report > Filters Tab > Sales Tax Code > Change to All non-taxable codes > OK

Obviously the more detailed the non-taxable codes are, the more useful the report becomes. In California, for example, the non-taxable transactions need to be detailed based on various categories on page two of the return. If the sales tax code list is organized in the same way, the return can be prepared more efficiently.