16 Nov Sales Tax Information

Sales Tax Information

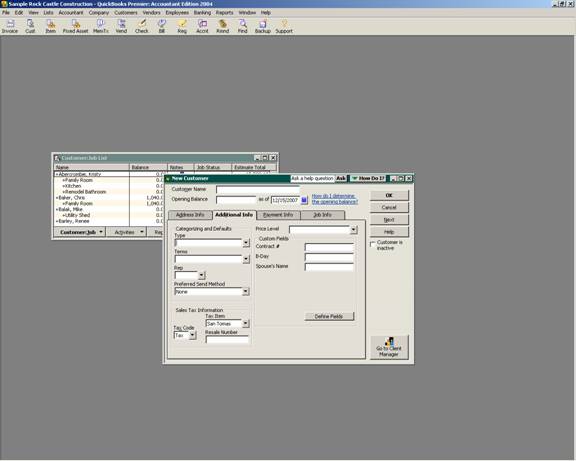

Just like for the items, version 2002 and higher uses the sales tax code list for determining the normal tax status for a customer. On previous versions, a box on the additional info screen served as a way to capture information about the customer's taxable status. If the customer is taxable box was checked, then sales tax will be charged on taxable items, if it was not checked, no sales tax will be charged to this customer. The sales tax item serves as the default as sales are made to this particular customer. The resale number field serves as a way to capture resale numbers as provided from the customer. It is simply a tracking tool. It is not, however, a substitute for obtaining a signed resale card in the case of a sales tax audit.

QBRA-2004: Lists > Customer:Job List > Customer > New > Additional Info Tab

TIP: If the box is not visible on the screen, it is because the sales tax preference has not been turned on.

TRICK: Use the customer phone list report and modify it to include these fields for an easier way to confirm any missing resale numbers.

List Limits Expanded

For most QuickBooks users, the list limit for the QuickBooks Pro and Premier products of 14,500 is sufficient. For some, however, that is not the case. We have been seeing increased list size for a variety of reasons. One of the most common is the increased number of customers as the result of web site sales. For version 6 and prior, the list limit was doubled for the Enterprise Solutions Product. New with version 7, the Enterprise Solutions limit has been removed.