17 Nov Sales by Item Summary Report vs Profit & Loss

Sales by Item Summary Report vs. Profit & Loss

(Case Study)

When reconciling the sales by item summary report to the Profit and Loss Standard report, the two reports should, in theory, agree. When they do not match, the issue is usually one of the following:

1. Both reports are not prepared on the same basis (i.e. cash or accrual) or the same time frame.

2. Revenue is entered directly into a bank register or onto a deposit slip. The result is income that is not on the sales by item report. Only items entered onto invoices, sales receipts, and credit memos appear on the sales by item report.

3. Sales items are not all coded to income type accounts. For example, down payments received from customers have been invoiced but coded to a liability account.

4. Sales items are used for purchases but the advanced job costing features have not been used so the sales and the purchases are both coded to the same general ledger account.

Here is an example for the purposes of illustration:

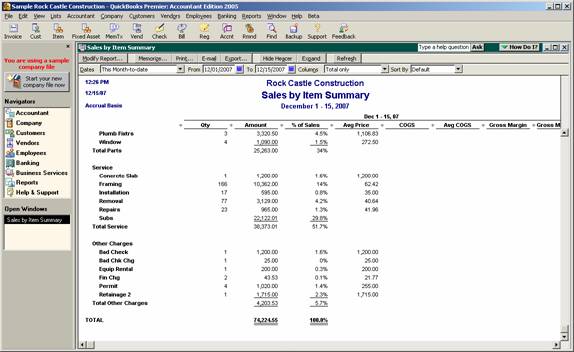

The sales by item summary report shows a total for the period 12-1-07 to 12-15-07 of $74,224.55 on the accrual basis.

QBRA-2005: Reports > Sales > Sales by Item Summary

The Profit and Loss Standard shows a total for the period 12-1-07 to 12-15-07 of $71,288.05 for total income on the accrual basis.

QBRA-2005: Report > Company & Financial > Profit & Loss Standard

The difference is $2,936.50. The easiest place to start to find the difference is to look at the other charge section of the sales by item summary. In the case we are looking at, there are a couple of obvious differences:

- Bad Check item with sales of $1,200 (typically this item is coded to the bank account, not an income account)

- Bad Chk Chg item with sales of $25 (typically this amount is either offset against the bank service charges if it is a pass through, or to an other income account if it is marked up)

- Retainage2 item with sales of $1,715 (typically this amount is coded to a balance sheet account)

The total of these three items is $2,940 which means we still have a difference of $3.50. At this point there is a decision to be made regarding the cost/benefit of spending time looking for such a small amount. Assuming the amount will be found, this requires digging a little deeper. . .

The next easiest way to try to discover the problem is to do a transaction detail by account report and filter the report for the transaction types of invoice, sales receipt, and credit memo.

QBRA-2005: Reports > Accountant & Taxes > Transaction Detail by Account > Expand Report > Modify Report Display > place a check mark next to item > Filters > Transaction Type > Selected Transaction Types > place a check mark next to invoice, sales receipt, and credit memo

Now, scroll through the transactions looking for anything odd. For example, the first entry in the checking account is OK because the sales receipt was deposited directly, we already addressed the $1,200 entry, then Accounts Receivable is typically OK, as are any inventory or income accounts.

When we get to the bottom of the report, there is something that is odd: A credit in the freight and delivery expense account in the amount of $70.

QBRA-2005: Reports > Accountant & Taxes > Transaction Detail by Account > Expand Report > Modify Report Display > place a check mark next to item > Modify Report > Filters > Transaction Type > Selected Transaction Types > place a check mark next to invoice, sales receipt, and credit memo

By double clicking on the amount and looking at the invoice, it is obvious this is reimbursed expense.

Because this amount does not have an item, it does not appear on the sales by item detail report, in addition, because the preference has not been chosen to track reimbursed expenses as income the amount does not show as income on the Profit & Loss report either (i.e. a net effect of zero). Also, by looking at this same invoice, the $3.50 variance can be seen as the markup on the reimbursed expense, since this item has been coded to Miscellaneous income it will appear on the Profit & Loss in the income section, however, it does not have an item assigned to it, so it will not appear on the sales by item summary report.