23 Nov Sale of Items

Sale of Items

Depending on the customer’s method of payment, the sale can be entered using the sales receipt or invoice form. Both are easy to use. They are completed by filling in the form, with the only difference being that payment is received at the time of the sale for the sales receipt, or the sale is on account and will be paid later by the customer when using the invoice form.

Sales Receipt: Selling the item by creating a sales receipt will automatically increase cash (or undeposited funds), increase sales, increase cost of goods sold, reduce inventory, and increase sales tax payable, if appropriate.

Invoice: Selling the item by creating an invoice will automatically increase Accounts Receivable, increase sales, increase cost of goods sold, reduce inventory, and increase sales tax payable, if appropriate. Subsequent steps will be to receive the payment from the customer and deposit it into the bank account.

TRICK: To make sales tax return preparation easier, be careful to choose the correct sales tax item. It is very helpful to create one for Resale, Government, Out-of-state, etc. to make the return preparation process more efficient. New with version 2002 and higher is improved flexibility in the sales tax features including the ability to designate why an item or customer is taxable or not. In addition the sales tax liability report has been changed to include totals and drill down capability.

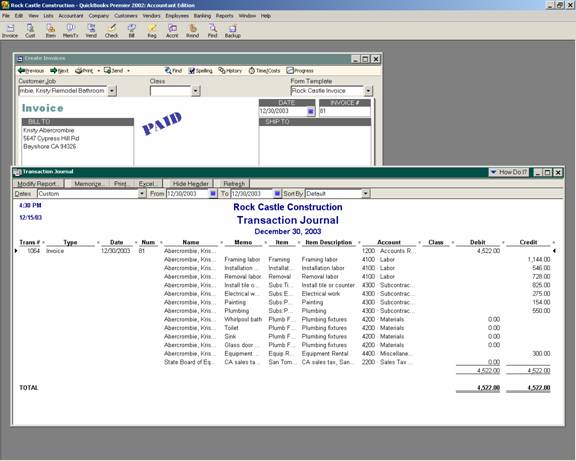

TRICK: These transactions can be confusing in regards to what is happening in the general ledger. Each form creates a journal entry as the transaction is saved that will detail the reduction in inventory based on the average cost of the item at the time. This procedure to view the journal entry will work for any form in QuickBooks, any version. Version 2003 Accountant Edition added a journal button to the top of the invoice and changed the format to include the debit and credit columns. For any versions choose Reports > Transaction Journal.

QBRA-2002: Open the form > Reports > Transaction Journal > Modify Report > Display Tab > Remove the check mark next to Amount > Add a check mark next to Debit and Credit > OK