15 Nov Retained Earnings Drill Down

Retained Earnings Drill Down

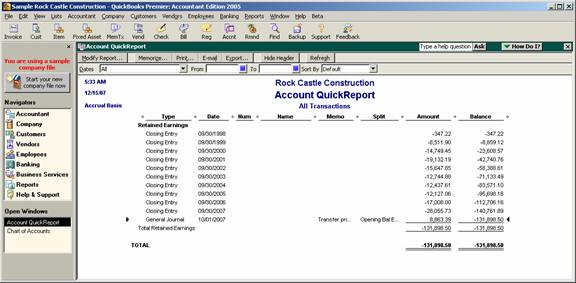

New with version 2005 is the ability to drill down on Retained Earnings from the chart of accounts list or from a Balance Sheet report. The result is a report that will show the Retained Earnings effect of the closing entries each year, as well as any other transactions coded directly to the account.

QBRA-2005: Lists > Chart of Accounts > Double click on Retained Earnings

From the report it is possible to double click on any transaction except the closing entry to drill down.

Editorial Comment: While this is helpful, it is the opinion of this author that it still does not go far enough. There is a closing date exception report that when used in conjunction with the closing date and this report will make research of any differences much easier. However, if historical transactions are changed for prior closed periods, the closing entry is simply updated to reflect those changes; I would like to see those changes included specifically on this report to make the research even easier still. If you agree, please go to Help > Help & Support and submit a suggestion for this change. It Intuit hears from enough of us, it will hopefully press the issue higher up on their priority list.