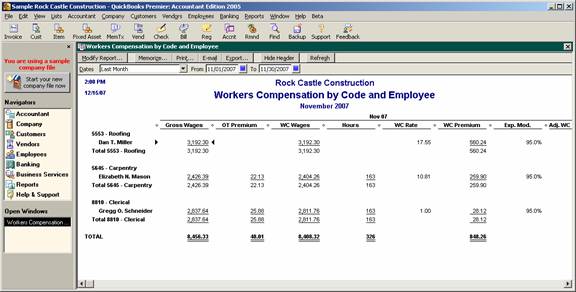

18 Nov Reports: Workers Comp by Code & Employee

Workers Comp by Code & Employee

New with version 2005 is the ability to assign workers compensation codes to payroll at the time the employee is set up, and when the paychecks are created. There is also a preference to help control the feature so the balance due for workers compensation insurance is accurately calculated.

Based on the information contained in all of those areas, the result is a variety of standard workers compensation reports available.

Included on the Workers Comp by Code and Employee report are Gross Wages, OT Premium (assuming the wages are reduced for the amount of excess included in overtime wages) and the resulting workers compensation wages. A column is available for the hours. The WC rate column is multiplied by the workers compensation wages to arrive at the calculated premium amount. That amount is then adjusted by the experience mod, if appropriate, to arrive at the adjust premium due. The report is summarized by workers comp code with supplemental summary information by employee.

QBRA-2005: Reports > Employees & Payroll > Worker Comp by Code and Employee