17 Nov Recording Net Credit Card Deposits

Recording Net Credit Card Deposits

Q – We now accept credit cards from our customers. The process has improved our cash flow, but complicated our accounting. Do you have any suggestions on how to streamline the process to make the bank reconciliation process easier?

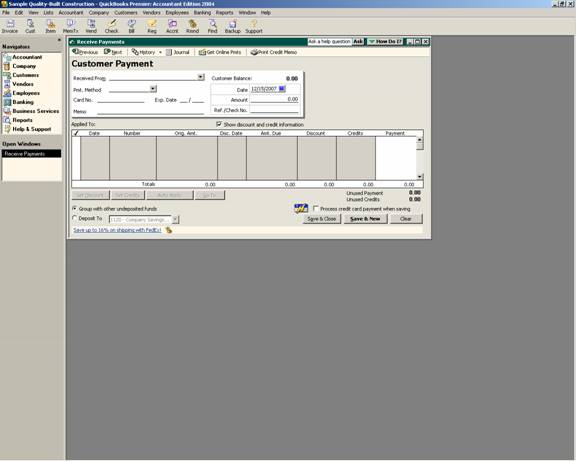

A – As you process the credit cards as either sales receipts or through the receive payment function, be sure to mark the radial circle to “group with other undeposited funds.” Entering the payment method is helpful since different credit card types are typically transferred to the bank account in total.

QBRA-2004: Customers > Receive Payments

The next step is to choose to make deposit from the banking pull down. All the customer payments will appear and those to be deposited together can be chosen by placing a check mark next to each one, or by choosing the select all button towards the bottom of the screen. New with version 2004 is the ability to only show payments of a certain type. This helps to streamline the process of choosing those payments that are included in one deposit into the bank account.

QBRA-2004: Banking > Make Deposit

If the amount is received from the credit card company net (i.e. the credit card company keeps their fee from each deposit) it is possible to enter the fee directly onto the deposit slip with a negative amount. There is a calculator function built in, so if the fee is a percentage of the total deposit, press – then type the number, then press the * key for times and then the percentage as a decimal (i.e. 3.45% is .0345) and then enter to have the computer calculate the fee. The fee will appear as a negative number to reduce the total deposit amount. The result is a total deposit that should match the bank statement.

Example:

Customer ABC owes invoice 123 in the amount of $1,000.00. They call and say they would like to pay for the invoice using their American Express Credit Card. The business accepts American Express as a form of payment and receives the amount net of a fee of 3.45%. The credit card number and related information is obtained from Customer ABC and a receive payment is entered into QuickBooks for $1,000.00 with the payment method of American Express and the radial button marked to “group with other undeposited funds.” If the Merchant Service is provided by QuickBooks, the payment will be automatically processed when saving the transaction by checking the box in the lower right hand corner. Otherwise, the appropriate method of processing will need to be completed (for some businesses it is processing the charge through a machine, for others there is an on-line alternative). In this case, the discount is known (keep in mind there may be a transaction fee or other fees in addition to the discount fee for some credit card merchant accounts) so it is possible to make the deposit by choosing the receive payment that was just entered, seeing it on the deposit slip, clicking on the line below the receive payment and entering the account (typically bank service charges, credit card processing fees, or something similar), optionally enter American Express as the payment method and -34.50 in the amount column. Tab or click to the next line and the net deposit amount should be $965.50. This process will correctly show the customer balance paid in full, the discount is correctly reflected as a business expense, and the deposit into the bank account is also correctly reflected. The only other issue to keep in mind is that typically the deposit will take several days to “clear” the bank from the credit card company (so don’t spend the money too quickly).

TRICK: If there is a discount fee and a transaction fee, it may be easier to sign up for on-line banking and complete the make deposit function once the deposit is actually received into the bank account if the day to day balance is important. With most credit card processing companies they also have an online reporting function to see the actual deposit detail information in real time.

TRICK: If the business does not need an “up to minute” accurate bank balance, it may be acceptable to enter the deposit at gross (amount received from the customer in total) and then enter the credit card processing fees monthly (keeping in mind that QuickBooks will always be a little higher than the bank until the adjustment is entered). Each credit card company supplies a statement either on-line or through the mail that will show the individual charges less the fee for each deposit that can be used to reconcile the deposits manually.

TRICK: If the payment is received net, a call to the credit card company may result in a change to receiving the whole amount and the fee withdrawn from the bank account monthly. Occasionally such a change will result in a difference in the time it takes to receive the money or a change in the discount (i.e. fee) that is charged for the transactions.