17 Nov QuickBooks Tips & Tricks – Sales Tax Code List

QuickBooks Tips & Tricks – Sales Tax Code List

Sales Tax Return preparation can be a challenging process is the client has many different types of non- taxable transactions. Some are relatively easy using the sales tax type of item such as government and out of state. Others become much more challenging when a customer may have taxable and non-taxable transactions within one sale.

The reason that the sales tax item is usually not sufficient for effectively tracking non-taxable sales is because many jurisdictions require a detailed accounting of why the transactions were non-taxable. For purposes of discussion here, let’s deal with the two different issues separately.

Entire transaction is non-taxable because Customer:Job is not charged tax

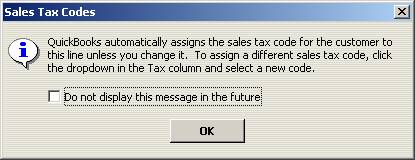

For some reasons, such as out-of-state sales or sales to the government, the entire transaction is non-taxable because the customer has been designated a non-taxable during the set up process. If the customer is set up using the appropriate non-taxable sales tax code as well as the appropriate sales tax item, the software will make the required modifications to the item detail lines. The follow box up box will appear unless it is marked to not display in the future to remind the user of what is happening.

Note: If the customer is marked with the taxable sales tax code, however, the sales tax code set as the default with the item will be used.

The common situation, however, is that a QuickBooks data file was created prior to version 2002, so when the customer:job list was converted to the newer version, by default all customers were set to use the taxable sales tax code. This can also happen with newer data files where the issue has not been addressed. The result is a sales tax liability report that includes taxable and non-taxable sales with a sales tax percentage of zero. If the sales tax type item was set up without a vendor, these items appear at the bottom of the report with a separate subtotal. Because the amounts are designated in this way, most QuickBooks users have never taken the time to clean up the report since the sub-totals are easily transferred to the sales tax return.

The transaction contains taxable and non-taxable detail lines

The challenge in this situation usually is that there may be various reasons why the item is non-taxable. Some common examples are labor, consulting, customer buying the product for the purpose of resale. Just like was noted above, if an item is always non-taxable for a specific reason, for example, installation labor, the item itself can be designated with the proper sales tax code. Just as was noted above, the most prevalent problem with most QuickBooks files in this area is that the sales tax codes were never set up to designate the reason “why” they simply are marked as non-taxable.

QBRA-2005: Customers > Create Invoices

With a data file set up in this way, the only way to determine what was marked as non-taxable is to drill down on the total, modify the report to include the item column and change the subtotal to by item. By looking at the item, the reason for the transaction being non-taxable can be investigated.

QBRA-2005: Reports > Vendors & Payables > Sales Tax Liability > Double click on non-taxable sales subtotal > Modify Report > Add Item Column > OK > change total by to item detail

Editing the items for the correct sales tax code individually will help to correct the issue for the future. Confirming the correct sales tax code is used when invoicing is also critical.