17 Nov Profit and Loss Overview

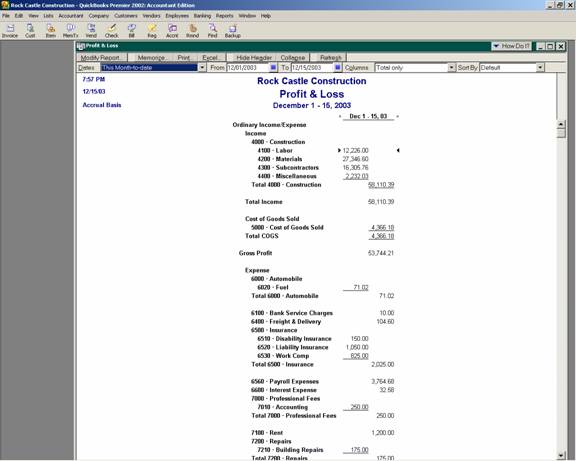

Profit and Loss Overview

(Also called an Income Statement or Statement of Operations)

This is a statement that most owners have some familiarity. They know that they need to maximize revenue and minimize expenses. The extent that they can control both, affects the money they have to personally take out of the business as well as the amount they have to give to the government in the form of taxes. Most have some gut feeling of what number they expect for a profit or loss.

The highest level of subtotaling is based on the account type; additional subtotals can be created by using accounts with sub-accounts. To not show the sub-accounts, click on the “collapse” button, to see the detail again, that same button now says “expand.” If the chart of accounts has been set up properly, the collapse and expand feature will solve many of the presentation issues.

One issue that cannot be handled within QuickBooks is a Statement of Retained Earnings. The calculations can be added to the bottom of the Profit & Loss in Excel, or a completely new statement can be created there as well.

This statement can be printed based on many different column formats. For example: include percentages, a column for year to date, by quarter, etc.

QBRA-2002: Reports > Company & Financial > Profit & Loss Standard

The most common choices for interim statements are by month or by quarter, then a total column. For year-end statements, a standard one column for the total or a comparative statement is usually the preferred presentation method. By choosing this report as a starting point, it is possible to also customize the report to add the percentage of income to each column.

Trick: If the Profit & Loss YTD Comparison report is chosen, however, the percentage of income column appears to the right of the YTD column, but is based on the left hand column. Starting with the standard Profit and Loss report will eliminate this problem.

TIP: If the Statement of Retained Earnings is added to the bottom of the Profit and Loss report in Excel, don’t forget to change the name of the report as well.