17 Nov In Process Bank Reconciliation Report

In Process Bank Reconciliation Report

Q – How do I print unreconciled banking reports? The print option when I am in the bank reconciliation screen is not available, it is shaded grey. (Submitted by Jasmine)

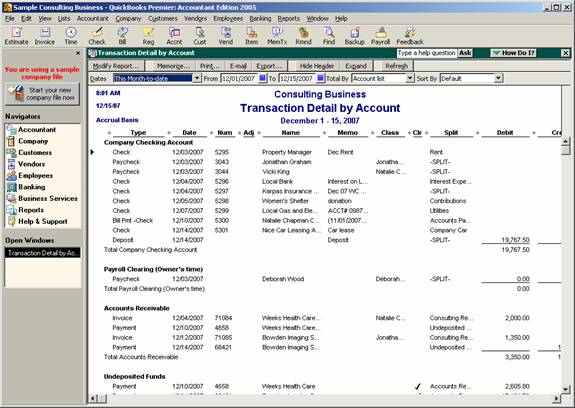

A – There are several ways that you can start with a transaction by account detail report and modify it to make the reconciliation process easier. This report is also updated as transactions are marked as cleared in the reconciliation window. This process provides flexibility for bank statements that are more complicated or contain excessive activity.

To begin, create a transaction detail report by account and then click on the modify button. By default this report includes the cleared column. If the transaction has a star (*) in the CLR column, it has been marked as cleared on a reconciliation that is in process. If the transaction has a dark check mark it was included on a previously completed bank reconciliation, and if the CLR column is blank, it has not been cleared through the reconciliation process yet.

QBRA-2005: Reports > Accountant & Taxes > Transaction Detail by Account

To make the report more useful for the purposes intended, filter for the specific account, the date range of all, and the cleared status of no. The cleared status of no will include those transactions that have not cleared (i.e. CLR column is blank) as well as those that are in the process of being reconciled (i.e. * in the CLR column).

QBRA-2005: Reports > Accountant & Taxes > Transaction Detail by Account > Modify Report > Filters Tab > Make appropriate changes to filters

Consider clicking on the header/footer tab to change the name of the report to something more appropriate.

Once the filters have been set, it is possible to change the way the report is sorted depending on what will be most useful. It may be most helpful to have the report sorted with what has cleared and what has not together, or possibly by the transaction type so all checks and all deposits appear together, etc.

TIP: Don’t forget to click on the memorize button to preserve the format for future use.