17 Nov Printing the 1099-MISC forms

Posted at 12:58h

in

- Printing the 1099-MISC forms

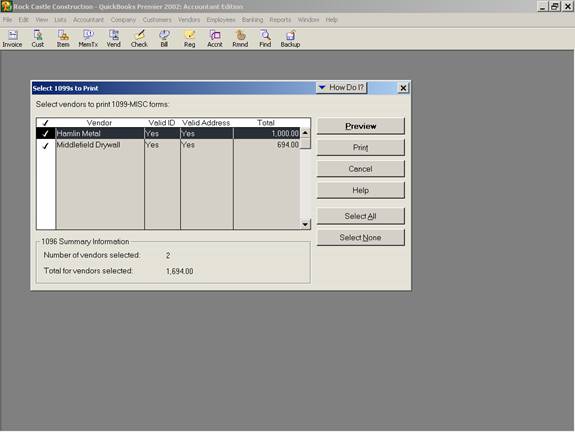

- Printing the forms is done through File > Print Forms > Print 1099 > Assign the date range > OK > a box then appears with a listing of all of the 1099-MISC forms to print. Note the 1096 information at the bottom, left hand side of the screen. QuickBooks does not print the 1096 form for Version 2003 and prior. It only provides the information to fill in on the form. The number of copies of form 1099-MISC required, up to 8 parts, varies by state. At a minimum, 3 parts are needed: one for payee, one for payer, and one for the Internal Revenue Service. Designate the number of copies to be printed at the bottom of the print screen. The pre-printed forms and corresponding envelopes are available from local office supply stores, or from www.intuitmarket.com, or by calling Intuit at 1-800-433-8810. The forms are usually available annually August through February.

QBRA-2002: File > Print Forms > Print 1099 > Assign the date range > OK