17 Nov Petty Cash Fund versus Expense Reimbusement

Petty Cash Fund versus Expense Reimbursement

Q – Can you please explain the difference between a petty cash fund and an expense reimbursement, including when each is most appropriate?

A – As a general rule, petty cash funds are only appropriate when the money will be spent from one central location (i.e. from the office). Expense reimbursement works best when the money is spent in various locations.

From a processing standpoint, expense reimbursement is easier.

- The money is spent as needed.

- The person who will be reimbursed submits an expense report with receipts attached. A mileage log or expense reimbursement form may prove helpful to standardize the process.

- Payment is issued for that exact amount. The coding of the check or bill is split as it is entered based on the types of expenditures.

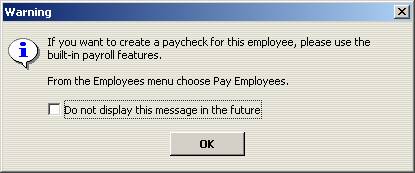

Tip: If the payment is to be made to an employee, a check will be required. When entering the check, a warning message will appear. Simply click on OK to continue to the check form.

QBRA-2004: Banking > Enter Check > Choose the name of an employee

QBRA-2004: Banking > Enter Check > Choose the name of an employee > OK > Enter check amount > Enter split detail

To pay an employee by entering a bill, a vendor will need to be created with a slightly different name (i.e. maybe add vendor to the end of the name to make it obvious which is which). The bill screen would be completed in the same way as the check with the split detail.

With a petty cash fund the accounting procedures would be as follows:

- Decide how much of a fund is necessary (we will use $100 in this example).

- Establish the petty cash fund by issuing a check written to cash and coded to a petty cash bank account (i.e. cash on hand).

- Cash the check and place the money in a safe, secure place (maybe a lock box kept in a desk?)

- As money is spent, receipts are accumulated. The total in the box should always equal the amount of the fund: $100 in our example. This includes receipts, cash, or a combination of both.

- When the cash gets to be replenished, the receipts are removed and a check is issued to cash for that exact amount. The check should be split as it is entered based on the receipts.

- The check is then cashed and the money replenished.

Note: unless the petty cash fund amount is increased or decreased, there should not be any additional entries to the petty cash fund general ledger account.