15 Nov Payroll Returns: 940EZ

Form 940-EZ

In the past QuickBooks has included the Form 940 for those who process payroll through the software. Form 940-EZ was not supported so the form needed to be filled out manually, or many small businesses just submitted the Form 940 instead. All of that has changed with version 2005. An interview form has been included to determine which form is required, then the software will prepare the form as needed.

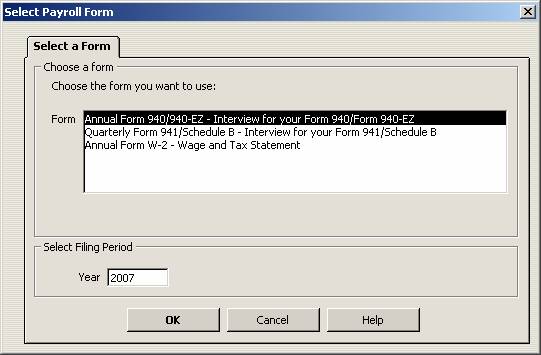

First, from the employee pull down menu, choose to process payroll forms then Federal, then the form 940/940-EZ.

QBRA-2005: Employees > Process Payroll Forms > Federal > Select a Form

A warning will appear that the form may not look like the one from the payroll agency. The form on the screen has been slightly altered to make it easier to review the information and make edits as required.

QBRA-2005: Employees > Process Payroll Forms > Federal > Select a Form > Annual Form 940/940-EZ . . . > Confirm Year is Correct > OK

The interview form contains a series of questions that are used to determine which form will be required. The interview form continues to permit marking that this is the final return, an amended return, and the ability to specify any exempt payments. At the bottom of the form is the reminder to click on the Next arrow to review the form for accuracy and completeness.

QBRA-2005: Employees > Process Payroll Forms > Federal > Select a Form > Annual Form 940/940-EZ . . . > Confirm Year is Correct > OK > OK

If these three questions are answered yes the form 940-EZ will be permitted. It is possible to check the form to make sure there are no errors, or click on Next to see the actual form on the screen. Next again will show the Filing and Printing Instructions on the screen (or choose from that option at the bottom of the form) and then print the form or save as PDF.

QBRA-2005: Employees > Process Payroll Forms > Federal > Select a Form > Annual Form 940/940-EZ . . . > Confirm Year is Correct > OK > OK > Answer questions and complete form > Print

To change the printer, choose Set Up, otherwise, if everything appears correct, click print.

Note: At the time of this writing Intuit was waiting for the approval of the form from the U.S. government so when printed the form has a “Do Not Print” watermark. The information can be transferred to the actual form provided by the governmental agency if the approval is not received by the time the filing is required.

After the form has been printed there is a pop up reminder to make any changes in QuickBooks directly that might have been made on the form itself.