17 Nov Payroll Liability Adjustments

Payroll Liability Adjustments

Payroll liability adjustments are needed very infrequently. Occasionally, however, there is the need to adjust for an error in beginning balances, pervious data entry errors, etc. Great care should be used when making these adjustments due to the far reaching ramifications of adjustments that are not entered correctly.

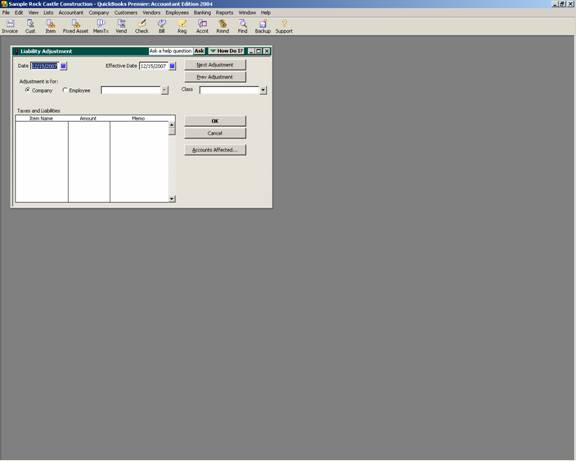

QBRA-2004: Employees > Payroll Liabilities > Adjust Payroll Liabilities

The entries can be entered for a specific date and effective date. The adjustment can affect the company, or a specific employee. The adjustment amounts by item can be either positive or negative. A memo is often helpful in the future if the adjustments appear on reports in ways that are not readily understood.

A commonly overlooked part of the entry is the accounts affected. Click on the “accounts affected” button to see if the accounts will be affected in the general ledger or not. No matter which option is chosen, the payroll reports will be affected by this entry. The only difference is if the general ledger accounts need to be adjusted also, or not.

QBRA-2004: Employees > Payroll Liabilities > Adjust Payroll Liabilities > Accounts Affected