16 Nov Payroll Earning Items

Payroll Earnings Items

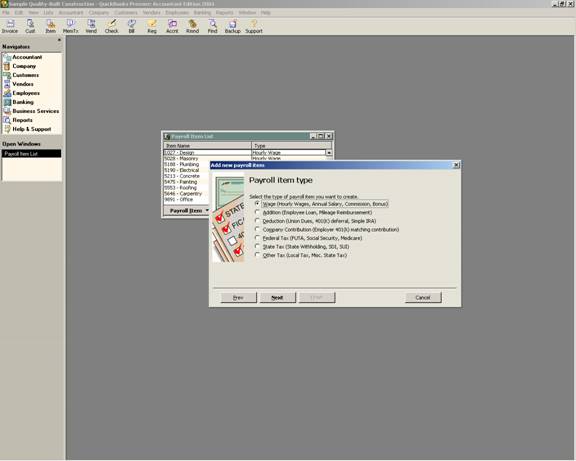

With Version 2004 and prior, the payroll earnings items include hourly, salary, bonus or commission type items. Typically these types of items are set up using the custom set up option.

QBRA-2004: Lists > Payroll Item List > Payroll Item > Edit > New > Custom Set Up > Next > Wage

QBRA-2004: Lists > Payroll Item List > Payroll Item > Edit > New > Custom Set Up > Next > Wage

QBRA-2004: Lists > Payroll Item List > Payroll Item > Edit > New > Custom Set Up > Next > Wage > Next > Hourly Wages > Next

Making the choice of regular, sick or vacation is critical if QuickBooks is going to be used for tracking sick and vacation time accrued, used, and available. Once the item is set up there is not anyway to change the choice. In addition, there is not any way, short of using the item when calculating a paycheck to confirm that if affects the sick or vacation item has been set up properly.

The next screen is for assigning the name for the item. The final screen is for assigning the general ledger account for the item.

TRICK: If the general ledger account is changed, all historical transactions that have used that item will be updated for the new account.

TIP: QuickBooks does not automatically calculate overtime, double time, etc. There is the need to set up the items for these additional wage rates. The regular hourly item choice should be used.

For overtime earnings, there were changes to these general procedures with Version 2005.