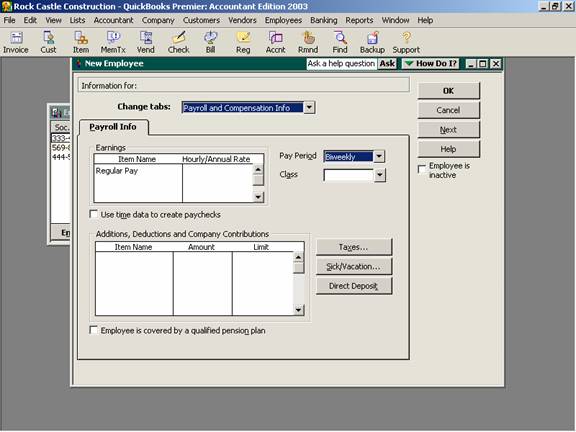

16 Nov Payroll and Compensation Info

Payroll Info

The Payroll and Compensation Info tab is the link between the payroll items and the employees. This information is used to calculate the net checks for the employee.

QBRA-2003: Lists > Employee List > Employee > New > Payroll Info

Earnings: All hourly or salary gross wage items for this employee would be entered into this section. If certain items are not needed on a specific paycheck, they can be deleted at that time or entered with a zero amount.

TRICK: Note that the heading is hourly (for hourly type gross wage items) or annual (for salary type items). For salary type items, the annual amount entered here is divided by the number of pay periods based on the pay period to arrive at a per paycheck salary amount. Don’t make the mistake of entering $1,500 on this screen next to a salary type item if that is a per pay period amount for a semi-monthly employee or their gross check will be $62.50.

Pay Period: Choosing the correct pay period is important for two reasons: First, it will calculate the pay period based on the period ending date entered when the payroll checks are created; and second, the appropriate tax table is chosen by the software to calculate the payroll tax withholding amounts based on the pay period, marital status and exemptions. Different employees can each have different pay frequency. Any combination is possible. For example, hourly employees may be paid weekly, salary employees may be paid semi-monthly, and officers may be paid monthly. Who is paid is dictated manually by placing a check mark next to the employee name when using the pay employee screen.

Class: If class tracking has been turned on, you may choose a class for this employee. If the class designation changes based on the activities or location of the employee at different times during the pay period, leave the field blank. This is, like the other information entered on this tab, able to be changed as the paychecks are actually created.

Use time data to create paychecks: This is a “Pro Only” and higher feature that permits entering timesheets for the employee and the time data is then automatically entered into the paycheck calculation screen based on the pay date for more sophisticated job costing and class tracking.

Additions, Deductions, and Company Contributions: These other payroll items can include such things as health insurance deductions, 401k contributions, commissions, bonus payments, etc. It is important to note that the order these items are entered may affect the amount QuickBooks calculates for each item and for taxes.

Sick/Vacation: If QuickBooks will be used to track the sick and/or vacation time due an employee, set up the calculation criteria using this section of the employee record. With version 2000 and higher is the ability to accrue sick and vacation time based on each hour worked. Prior to version 2000, only the “beginning of the year” or “every pay period” options were available.

TRICK: To reduce the amount of vacation and/or sick that an employee has, a vacation or sick hourly item must be used to pay the employee. For example, if an employee is salary but is taking 8 hours of vacation during the pay period, the paycheck would be changed to show the amount of salary for the rest of the period, then 8 hours of vacation to reduce the balance. For employees paid as salary but vacation and sick are accrued hourly, create the sick and vacation items and adjust the salary for the pay periods when the sick or vacation time is paid.

Direct Deposit: If an employee wants to have their paycheck put in their bank account via direct deposit, this is the section where their checking or savings account information would be entered. Each employee may have their net check distributed into one or two accounts.

Taxes: Each state has various required forms that must be completed by a new employee. Contact the State Labor Board to learn more about paperwork and posting requirements. In addition to any other paperwork such as emergency contact information, immigration paperwork (http://www.uscis.gov/graphics/formsfee/forms/files/i-9.pdf), employment agreements or the like, a W-4 form will contain the information necessary to enter a new employee into QuickBooks. This information is the employee’s address, social security number, marital status, exemptions, and any additional amounts to be withheld. Forms can be obtained from the local IRS office, from their web site at http://www.irs.ustreas.gov/pub/irs-pdf/fw4_03.pdf, or by calling 1-800-829-3676.

TIP: With version 2000 and higher, the sales rep list became independent of the employee list, and can now be linked to vendors, employees, other names, etc. The reason the Rep field may be important if payment is made based on sales. The Rep field on an invoice will then permit a Sales Report by Rep.

TRICK: In the older versions, the employee initials are used for the Rep field in Customer set up and when creating an invoice. For this reason, the initials of any independent sales representatives will also appear on this list.

TRICK: In versions prior to 2000, if a sales rep is considered an independent contractor, rather than an employee, it is extremely important to establish a slightly different vendor name for use when payments are made. This will permit the software to automatically generate an appropriate Form 1099 at the end of the year.