17 Nov Paying Sales Tax

Paying Sales Tax

Although sales tax will not be addressed here in detail because of the wide variety of issues based on location and industry, it is an important issue for many small businesses. Documents are available from the taxing authority for each location by industry to explain and clarify the rules. Keep in mind that the rules may not always be logical. For example, in California the State Board of Equalization has mandated that if a printer prints postcards and the customer picks up those post cards to mail them sales tax is charged. If, on the other hand, the postcards are sent directly to the mail house for processing, the printer does not charge sales tax.

A brief mention, however, is important to distinguish paying sales tax as opposed to other bills.

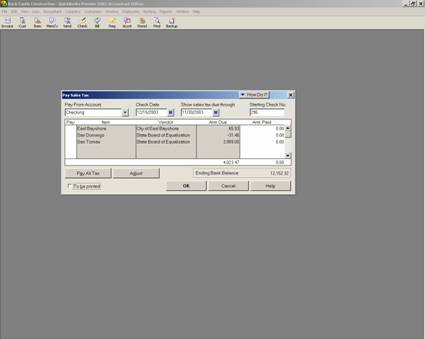

QBRA-2003: Vendors > Pay Sales Tax

QuickBooks automatically accumulates amounts due during invoicing for the sales tax liability. Following this procedure will permit assigning the payments to the correct sales tax items. If you have an amount without an item, this is usually the result of a journal entry or entries directly into the sales tax payable register. New with version 2002 and higher are additional codes, reports, and adjustment options. More information on Sales Tax Reports.

TIP: Don’t forget to double check that the sales tax preference is set correctly.