17 Nov Offset A/R and A/P Using Journal Entries

Offset A/R and A/P Using Journal Entries

In this example we will look at offsetting amounts owed to a customer and a vendor using journal entries.

The other two alternatives are: using a bank clearing account or entering a credit and credit memo for the vendor and customer, respectively using a clearing item.

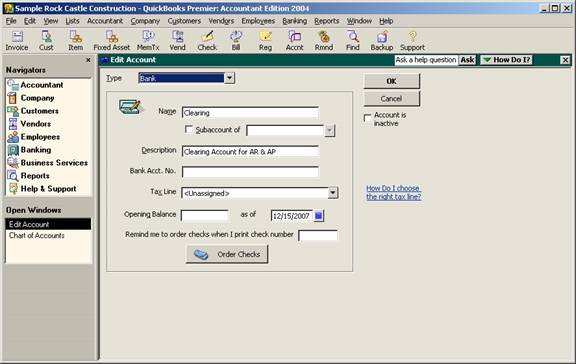

The first step is to create a clearing account on the chart of accounts. Any type of account will work since the balance should always be zero. For our example, we will use the bank type of account. For our purposes here, we will name the account “Clearing.”

QBRA-2004: Lists > Chart of Accounts > Account > New

To reduce the amount owed by the customer, create a journal entry using the Clearing account as the offset.

QBRA-2004: Company > Make Journal Entry

To reduce the amount owed to the vendor, create a journal entry using the Clearing account as the offset.

QBRA-2004: Company > Make Journal Entry

Double check that the ending balance in the clearing account is zero. Like any Balance Sheet account, it is also possible to reconcile this account. The reconciliation procedures can be helpful in finding the problem if the balance is not zero.

QBRA-2004: Lists > Chart of Accounts > Clearing > Activities > Use Register