17 Nov Making Deposits

Making Deposits

This function is for depositing checks received from customers (through the receive payment option described in detail in the Accounts Receivable materials) or for recording miscellaneous amounts received from sources other than customers, such as loan proceeds, rebates, etc. The later can be added to a deposit slip that has been created from undeposited funds or as a separate transaction.

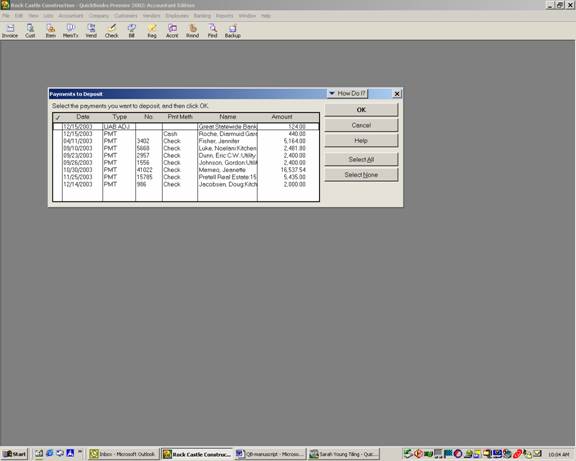

QBRA-2002: Banking > Make Deposit (Note this screen will not appear if there are not any payments that have been entered through undeposited funds, once the appropriate amounts have been marked for the deposit slip and OK has been chosen the next screen will appear)

QBRA-2002: Banking > Make Deposit (Note the previous screen will not appear if there are not any payments that have been entered through undeposited funds, the screen below will simply appear)

TIP: As an internal control procedure, print the deposit slip and attach the bank receipt. This also makes investigation of any bank discrepancies much easier.

New with Version 99, QuickBooks added the ability to print the deposit slip on preprinted forms. The bank encoding information is pre-printed at the top of the form and a deposit summary is on the bottom 2/3 of the page. The change with version 99 was that when you print, you have two options:

- q Deposit slip and deposit summary

- q Deposit summary only