17 Nov Unable to Import Accountant’s Changes

Unable to Import Accountant’s Changes

Q – I made adjusting entries and sent back a QBX file. Client”s computer had “Import Accountants” grayed out. I suggested that he go through the motions of “Clear Accountants Copy” and then create “Create Accountants Copy” and try importing my changes. Apparently my changes were identified as from a different copy and would not accept it. What is the best way to overcoming this situation?

A – It sounds like the client had cancelled the Accountant’s Copy. Once that is done, the link between the Accountant’s Review Copy you have and the database of the client has been severed and there is no way to fix that. The only alternatives now are to: send the client a hard copy of the changes you made for them to re-enter; for you to access the data file either in person or using a remote access alternative to re-enter the changes into their existing file; to have the client cancel the Accountant’s Copy if they currently show that one is outstanding then create a new Accountant’s Review Copy for you to re-enter the information; or to use a transaction copier tool that will permit creation of a transaction file that the client can simply import.

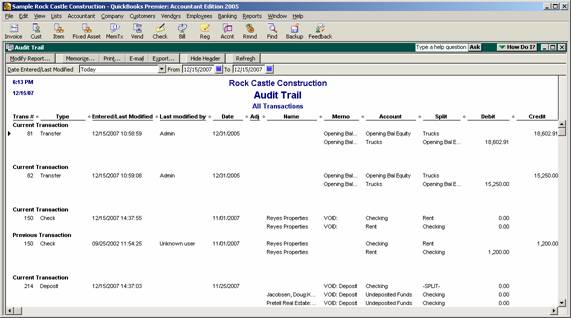

For the first three alternatives: To create a report most efficiently of the changes you have made, consider using the Audit trail report. The advantage of this report is that the date range is easily modified at the top of the report (no need to modify the report to filter for the entered/modified date) and, if the audit trail is turned on, it is easy to see exactly what changes were made to any entries. By virtue of using the Accountant’s copy, the changes are usually just entering new journal entries, so even if the audit trail has been turned off, the report should still be easy to review.

QBRA-2005: Reports > Accountant & Taxes > Audit Trail > Change the date range to be the time period that the accountant has been working on the file

Be sure to review the report to note any new accounts or names that may have been created and won’t be in the new file to make the data entry process as efficient as possible.