18 Nov Change Year End

Changing Year End

For most businesses, when the QuickBooks file is set up, the first month in the fiscal and tax years are entered and this entire issue can be ignored. However, there are two common reasons why the year end may need to be changed in a QuickBooks file.

By far the most common reason is that the first month in the fiscal year was set up incorrectly from the beginning. This is usually the result of new businesses entering the first month they were in business as opposed to the first month of the fiscal and tax year. Typically the error is found when running reports for the first month of the new year yet the year to date amounts include months from the previous year.

Less common, is the situation that the business has changed year end for income tax purposes. Occasionally the year end change is mandated by the government, but more frequently the change is the result in a change in legal form. For example a sole proprietor converts mid year to a corporation but does not start a new QuickBooks file for the new entity. To learn how to “split” the file if this is the situation, consider our free eReport on Starting Over. Or, if leaving the file with both legal entities intact is acceptable to the tax accountant, just be very careful when running reports around year end change.

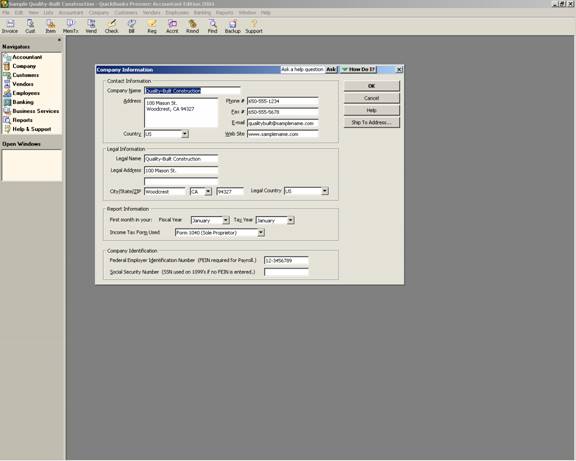

In either case, Company > Company Information is where the first month in the fiscal and tax year can be changed. The change will affect all of the historical reports created in the future. It is also possible on this screen to change the income tax form. Be aware, however, if the income tax form is changed, the tax lines assigned to each account will be removed and will need to be re-assigned using the correct tax form lines for each account manually. Be sure to exercise extreme caution and watch the date range on reports around the time of the change.

QBRA-2004: Company > Company Information