18 Nov Journal Entries from Forms

Journal Entries from Forms

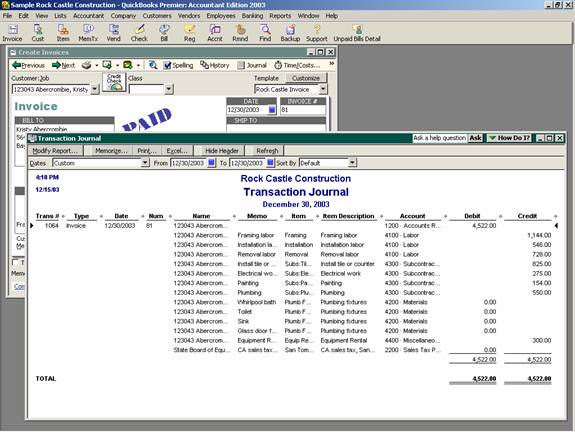

Many of the subsidiary ledger reports require that transactions be recorded using the appropriate forms to have the detail reports agree to the general ledger. This can be true for custom reports that have been filtered for specific transactions types as well. For some accountants the use of forms can be frustrating because the journal entry that is created is not readily apparent. For checks or bills, for example, the expense account is visible when using the expense tab. If the items tab is used, however, the account code is based on how the item was set up and cannot easily be viewed from the form itself. Creating payroll checks is another situation where the account that will be affected is not readily apparent since the coding is based on how the item was set up. It is possible, however, to generate a report to see exactly how the general ledger has been affected by a transaction. The example used below is for an invoice, but the same procedure would be used regardless of the form.

QBRA-2003: Customers > Create Invoice (click on previous to move to an existing invoice) > Journal

New with QuickBooks Premier 2003 the default columns on the report are for the debit and credit columns rather than amount.