16 Nov Journal Entries

Journal Entries Overview

In traditional accounting, the journal entry is a record of a transaction in which the total amount in the Debit column equals the total amount in the Credit column, and each amount is assigned to an account on the chart of accounts. For the day-to-day transaction entry, QuickBooks uses familiar forms (invoices, bills, checks, etc.) and the journal entries are created automatically. When you enter a transaction directly into a non-bank balance sheet account register, QuickBooks automatically labels the transaction GENJRNL in the register and General Journal on reports that list transactions.

There are no period-end closing entries. In traditional accounting systems you must perform various closing procedures. QuickBooks automatically transfers net income into the Retained Earning account at the beginning of a new fiscal year when Balance Sheet reports are created. You cannot view a journal entry to see this process, it occurs automatically.

TRICK: If the net profit or loss each year should be “closed” into an account other than Retained Earnings, there are two ways to handle this issue. One is to change the name of the account (i.e. for a sole proprietorship change the name of Retained Earnings to Owner’s Equity). The second alternative is to create a journal entry to reclassify the amount correctly (i.e. reclassify retained earnings to various partner accounts). To protect the integrity of the data for the future, use the password protection feature of closing dates as described in an earlier chapter.

All transactions are recorded automatically as they are entered. The feature exists on the company pull down menu to make journal entries (in previous versions it was activities, enter special transactions). In traditional accounting systems, to “post” is to transfer data from the book of original entry to a ledger. In QuickBooks, the original entry is on a form (invoice, bill, check, and so on), and the equivalent of a ledger is a report. QuickBooks handles all posting automatically and immediately when you record the form.

QuickBooks allows you to correct mistakes by editing and recording the original form again at any time. To protect previous records from accidental change, use a QuickBooks password and closing date.

Entries for depreciation, tax provisions, etc. must be made in the more traditional fashion. For clients using job costing reports, there are several places which do not permit you to assign a customer to the amounts, so a journal entry is required to reclassify the amount within the same account from no name (i.e. blank) customer to the correct customer:job.

With many traditional software packages, any adjustments are handled through journal entries in the general ledger. In QuickBooks, however, the creation of journal entries, and their impact on the financial statements, may not achieve the desire results.

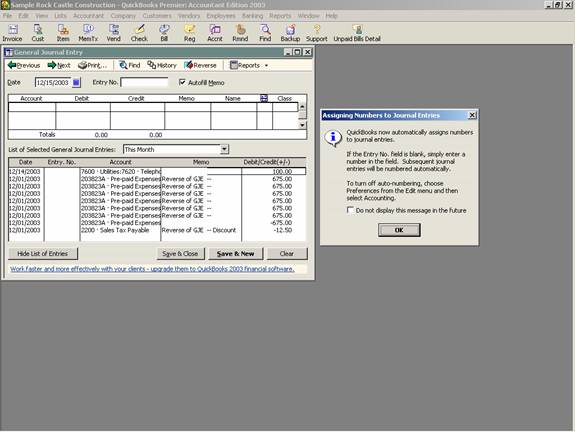

QBRA-2003: Company > Make Journal Entries

Each transaction is recorded in the general ledger via journal entries. It is possible to create a report that presents the details for each transaction. This report, by default, in QuickBooks Premier Version 2003 includes the feature of collapsing the detail lines for the same account into one line. This is indicated by the notation of “multiple” in the memo column. To see the individual detail lines, click on the expand button at the top of the report. This report can also be filtered for a specific transaction type (for example, journal), by date entered/modified, by a specific memo, etc.

QBRA-2003: Reports > Accountant & Taxes > Journal