17 Nov Job Costing Salaried Employees

Payroll Calculations

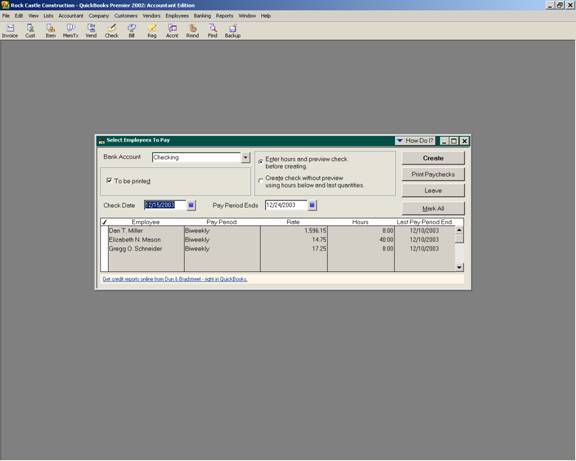

To pay employees, choose Employees > Pay Employee and select the employees to pay by placing a check mark to the left of the employee name.

QBRA-2003: Employees > Pay Employees

Select the check date and period end date as appropriate. It is recommended that paychecks be previewed before they are created unless the employees are salaried (or always work the same number of hours) and they are all just receiving their standard paycheck.

Confirm that the correct bank account has been selected and the “To Be Printed” box has a check mark in it. It is recommended that this box be checked even if checks will be hand issued. The reason is that otherwise the computer will assign the check number, which will most likely not agree with the check number actually issued. By having the paycheck appear in the check register with a “To Print” notation, it is possible to quickly determine those that require the number of the actual check issued to be entered. With Version 2001, the option to set the default bank account as a Checking Company Preference was added (other types of payments can be set using the “My Preference” tab).

QBRA-2003: Edit > Preferences > Checking > Company Preferences

When all the fields on the window have been modified as necessary, choose Create.

Review each paycheck to ensure accuracy. If hours or other payroll items need to be entered or modified do so.

If an outside payroll service is used and the paychecks are being created for job costing purposes, match the net checks to the payroll register provided by the service. If any differences are noted, change the paycheck in QuickBooks to match the one from the service to eliminate any checking account variances. The only changes should be Federal or State Withholding amounts since everything else is usually calculated on a set percentage from the tax tables.

TRICK: If employees are to be paid from timesheets and the time data does not appear automatically, click on the cancel button at the bottom of the window. Next, edit the employee list to choose “Use time data to create paychecks,” then try to create the paycheck again.

QBRA-2003: Employees > Pay Employees > Create

TIP: To print the various forms, choose File > Print Forms > then the appropriate form (i.e., Timesheets, Paychecks, or Pay stubs). The paychecks can also be printed from the Select Employees to Pay screen.

TIP: Assisted Payroll Calculations – The processing and printing of net payroll checks is exactly the same as described previously, with one additional step of actually transmitting the payroll. The transmission of payroll will transfer the information for return processing and results in the payroll fee, tax impound, and direct deposit impound (if applicable) automatically being entered into the check register.

When this process is completed for the first employee who has direct deposit, QuickBooks will automatically create a new payroll item called direct deposit on the payroll item list. This new item will be used on the Employee Summary table on the Preview Paycheck Window when payroll checks are calculated. This option will then be available as needed.

Once the payroll has been calculated and submitted to the payroll service, you can only change the memo, check number, print status, cleared status (for reconciling), bank account the check was written from, and the expense and liability accounts effected (if the payroll items are modified). If a check is voided, it will affect the amount of taxes and liabilities due, but the net check amount will need to be returned to the employer from the employee directly. The payroll service cannot impound the employee’s account for the amount due back to the employer for incorrect or voided checks.

TIP: If an employee has chosen to use Direct Deposit, a check will be printed and marked as “Advice of Deposit – Nonnegotiable.” The Direct Deposit amount and QuickBooks fee will be entered into the check register automatically by the software when the payroll is submitted. These entries appear with a lightening bolt symbol next to them to designate that they are electronic transactions.

TIP: Any corresponding charges for use of the direct deposit option will only be incurred if it is used.

TRICK: If the direct deposit box is checked on the “Preview Paycheck” screen when calculating the check, a direct deposit service charge will be incurred even if the net check amount is zero. To eliminate the charge, uncheck the box for this one paycheck.

TIP: The payroll should be transmitted for direct deposit and assisted payroll at least two days prior to the pay date to eliminate the warning that the deposits may be late and a fee ($50.00) may be charged.