15 Nov Job Costing and Item Tracking for Payroll Expneses

Job Costing and Item Tracking for Payroll Expenses

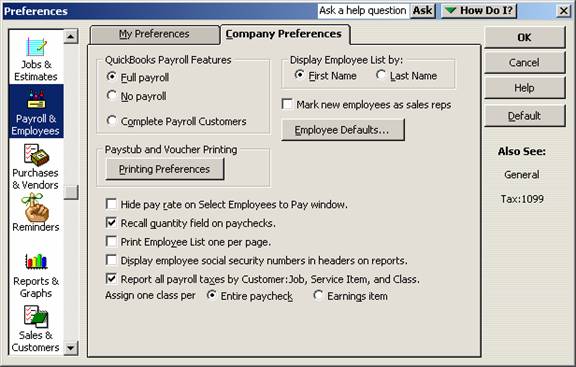

The wording of this preference has changed slightly in version 2005. This preference wording will also change depending on how the class tracking and time tracking preferences have been set.

In version 2004 and earlier for Pro and higher products, it was possible to mark the preference to report all payroll taxes by customer:job, service item and class. The payroll taxes are allocated based on the allocation of the earnings used as the basis for calculating those payroll taxes. By default this preference was turned off.

The payroll taxes are allocated based on the allocation of the earnings used as the basis for calculating those payroll taxes. If the preference is turned on and the company contribution or addition payroll item is marked to track expenses by job, the additions and company contributions will be tracked as expenses by job. The result is allocation based on earnings as with the payroll taxes.

Note: the company contributions and addition type payroll items are allocated on the basis of earnings, there is not currently a way to specifically allocate those amounts on the preview paycheck screen.

QBRA-2004: Edit > Preferences > Payroll & Employees > Company Preferences

With version 2005 for Pro and higher products, this has been re-worded to say job costing, class and item tracking for paycheck expenses.

QBRA-2005: Edit > Preferences > Payroll & Employees > Company Preferences