16 Nov Item Types

Item Types

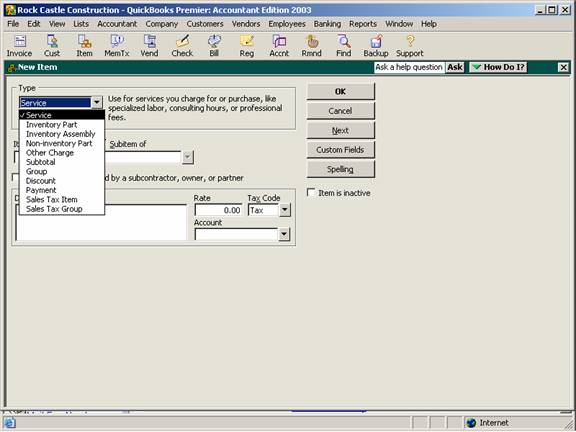

When creating an item list, there are several choices of item type to choose from. New with version 2002 was a brief description of the right of the choice on the screen as an item is created. New with QuickBooks Premier version 2003 is the inventory assembly type of item. The type is important for subtotals on reports and for some function options.

Below is a list of the types and the typical use for each:

· Service – most commonly used for items such as labor, consulting, hourly fees, etc. This type of item is required for use on timesheets.

· Inventory part – items that are normally carried in stock until sold. This item type will keep a running balance of quantity on hand and moving average cost. This item type will record purchases into an Other Current Asset account when purchased and reclassify the appropriate amount to cost of goods sold when an invoice or cash sale receipt is created. Detailed discussion of this type of item is beyond the scope of these materials.

· Inventory assembly – items that are created from other inventory items then carried in stock until sold. This is a new item type with version 2003, Premier only. This item type will keep a running balance of quantity on hand and moving average cost. This item type will record purchases into an Other Current Asset account when purchased and reclassify the appropriate amount to cost of goods sold when an invoice or cash sale receipt is created. Detailed discussion of this type of item is beyond the scope of these materials.

· Non-inventory part – items that are not kept in stock. This could include items such as custom or special orders. This item type is also used if the average cost method of valuing inventory is unacceptable or perpetual inventory counts are not necessary. As items are purchased, they are simply expensed.

· Other charge – freight, gift-wrapping services, expenses that are passed through to the customer are all examples of other charge type items. If an “opening bal” item is to be created for entering the beginning balances for a new set up for Accounts Receivable and Accounts Payable, this is usually the type that is used.

· Subtotal – a special item type that permits a subtotal line on an invoice to accumulate the amount due of all lines entered previously.

· Group – this item type is used when several items are sold at the same time. There is the flexibility of printing all of the individual components on the customer’s copy of the invoice, or showing the detail only on the screen with one line on the printed copy of the invoice that merges the detail together. The primary drawback to this item is, although inventory and any other items are correctly reflected as a group is sold, there is not a way to run reports on the group itself. For example, if an installed door set is sold that includes a door, the hardware, and labor, a sales report will show the appropriate amount of revenue for each component but will not show how much revenue was generated from the sale of the door set group, only how many doors were sold, installed or not.

· Discount – this is a reduction on the invoice that can be either a flat dollar amount or a percentage of the line immediately preceding it. If a discount is to be given off of each item, the discount will be entered either after each item, or once after a subtotal of all items.

· Payment – if a payment is received at the time of the invoice, this is item type to be used. Keep in mind, however, that a statement shows only the totals from transactions, i.e. the invoice on the statement will show the net amount due on the statement after the sale and payment have both been entered. If it is important to show the payment on the statement, entering an invoice then creating a receive payment transaction may be preferred.

· Sales Tax – based on the customer being taxable, and the item being taxable, this item will calculate the tax liability due based on the tax percentage entered.

· Sales Tax Group – in California, it is the recommendation of this author that the sales tax for each county be entered in total as a unique sales tax item, rather than entering the individual jurisdictions and grouping them together. The resulting sales tax liability report will be easier to reconcile using this suggestion.

QBRA-2003: List > Item List > Item > New

TIP: Create additional sales tax items to track other non-taxable entries such as resale, out of state, government, etc. It will make completing the sales tax return much easier.