17 Nov How QuickBooks Handles it

Cash vs. Accrual… How QuickBooks Handles it

Cash basis is a method of recording income as it is received and expenses as they are paid. Many service businesses use this method for income tax purposes. In QuickBooks this is usually achieved through simply entering checks and deposits, either on the forms, or directly into the register. Using this approach, it is not possible to generate accrual basis statements from the transactional data that has been entered.

Accrual basis is a method of recording revenue as it is earned (regardless of when it is actually received) and expenses are recorded as incurred (regardless of when it is actually paid). Many businesses that carry inventory are required to use the accrual basis of accounting for income tax purposes.

For management purposes the accrual method is usually preferable for several reasons:

- · Automation of invoicing, supplemental statements and reports to ensure all money due from customers has been or will be collected;

- · Automation of bills and pay bills functions including reports for managing the amounts due to others; and

- · “Matching” the revenue and expenses in the same period providing better information as to the profitability of current operations.

The discussion of the IRS rules of bookkeeping kept on an accrual basis requires that the tax payer report earnings and expenses on the accrual basis are beyond the scope of this discussion.

The Specifics…

By virtue of using the invoice and bill features of the software, the accounting records are kept on an accrual basis. The switch to a cash basis is strictly a reporting function based on the customization options chosen. The way that QuickBooks calculates a cash basis balance sheet is to first determine which open invoices and unpaid bills have been coded to Profit and Loss Report accounts. Then those amounts are “reversed” to reduce the balance of Accounts Receivable and Accounts Payable on the Balance Sheet. If all transactions for Accounts Receivable, for example, have been coded to income, Accounts Receivable on a cash basis would be zero. However, if a transaction has been coded to a Balance Sheet account, it will not be reversed. For example, Sales Tax Payable is a Balance Sheet account and will not reverse. If a QuickBooks file has only one invoice outstanding as of the Balance Sheet date that is an invoice for $108 ($100 coded to income and $8 coded to Sales Tax Payable). The accrual basis Balance Sheet will have an Accounts Receivable balance of $108. The cash basis Balance Sheet will have an Accounts Receivable balance of $8.

This feature is available for most reports. For financial statement purposes, it is often used for the Balance Sheet, General Ledger, Trial Balance, and Profit & Loss reports.

Let’s look at some examples of how the change from accrual to cash basis statements will be handled by QuickBooks:

|

Transaction Description |

Effect on Cash Basis Statements |

|

Bill for telephone expense, not paid at period end |

Will reverse for cash basis statements because telephone expense is on the P&L. |

|

Invoice for service revenue, not paid at period end |

Will reverse for cash basis statements because service revenue is on the P&L. |

|

Bill for purchase of computer hardware, not paid at period end |

Will not reverse for cash basis statements because the computer is a fixed asset. |

|

Credit card activity entered, not paid at period end |

Will not reverse because a credit card is not Accounts Receivable or Accounts Payable. |

|

Overpayment on a customer’s account |

Will not reverse because cash is a Bank type of account on the Balance Sheet. |

|

Purchase of inventory on a bill, not paid at the end of the period |

Will not reverse for cash basis statements because Inventory in an Other Current Asset type of account. |

|

Sales tax on an invoice, not paid at the end of the period |

Will not reverse for cash basis statements because Sales Tax Payable is an Other Current Liability type of account. |

|

Journal entry that includes A/R or A/P type accounts |

Will not reverse for cash basis statements because journal entries are always assumed to be cash basis, regardless of the accounts included in the entry. |

|

Bill Payment not linked to a Bill |

Will not reverse for cash basis statements because Cash in a Bank type of account – to fix, this requires a zero balance bill payment to link the two transactions. |

|

Receive Payment not linked to an Invoice |

Will not reverse for cash basis statements because Cash in a Bank type of account – to fix, this requires a zero balance receive payment to link the two transactions. |

Keep in mind, that if the error for the last two examples is found after the financial statements are issued (and the bookkeeper or accountant had not corrected the linking problem) this change could theoretically effect the financial statements into the prior period, resulting in difference in the prior period comparative numbers and a variance in Retained Earnings in the current period. This issue is beyond the scope of these materials, but is addressed in the Accounts Receivable (receive payments) and Accounts Payable (pay bills) materials.

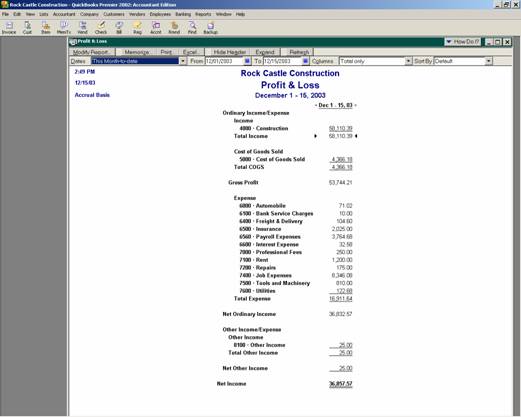

For an example of the profound effect the change from cash to accrual can have on the financial statements, review the following Standard Profit and Loss reports. Both reports are for the same company for the same period with the only difference being that one is prepared on a cash basis and the other on an accrual basis.

QBRA-2002: Reports > Company & Financial > Profit & Loss Standard > Collapse

QBRA-2002: Reports>Company&Financial>Profit&Loss Standard>Collapse>Modify Report>Cash