16 Nov First Time Finance Charge Calculations

First Time Finance Charge Calculations

When businesses first start charging finance charges, it is important to understand how the finance charge will be calculated and how to adjust the finance charges if needed.

When finance charges are assessed, the software will perform several tasks:

- See if an outstanding invoice has an overdue balance. It is very important to have any credits or unapplied payments “linked” to the invoice prior to beginning this process to ensure accurate finance charge calculations.

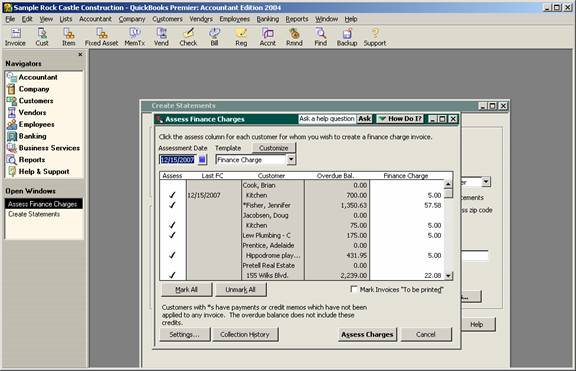

- Assuming there is an overdue balance, the finance charge will be calculated based on the rules established in the finance charge preference. The time period the finance charges will be assessed for the time will be from the date finance charges became applicable (i.e. due date or invoice date depending on the preference) to the assessment date as indicated at the top of the screen. In the future, the finance charges will be assessed from the date in the last FC column to the assessment date.

QBRA-2004: Customers > Create Statements > Assess Finance Charges (or, if statements will not be produced as part of this process, it is possible to just choose Customers > Assess Finance Charges)

Trick: Be careful the first time finance charges are calculated. Is the procedure truly to assess all the “back” finance charges or only the finance charges incurred in the last month due to the new policy? If it is for only the last month, the finance charge column on the assess finance charges screen should be overwritten with the correct amount. This would also be true if finance charges were previously calculated in another way. Do not simply let the finance charges calculate and then delete in the finance charge invoices because that will clear the “Last FC” column on the assess finance charges screen.