16 Nov Finance Change

Finance Charge Preference

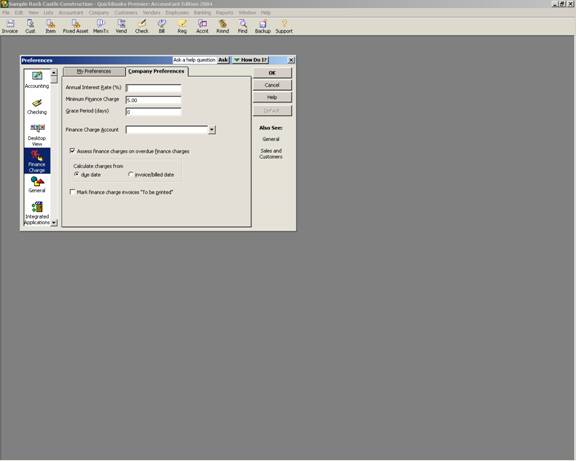

There are not any “My Preferences” to set for finance charge features. All the finance charge preferences are Company Preferences which means to change them requires the administrative user name and password.

QBRA-2004: Edit > Preferences > Finance Charge > Company Preference

Annual interest rate will be used to calculate the finance charge amount on the outstanding invoices.

Minimum finance charge is the amount that will be used when the calculated amount is below this threshold.

Grace period is the number of days from the due date that will be allowed before the finance charge is calculated.

Finance Charge Account is the general ledger account (from the Chart of Accounts) that will be used for recording the finance charge income. Typically the account type is income or other income.

“Assess finance charges on finance charges” is something that varies from state to state. In some states, this type of calculation is forbidden, in others, it is only permitted if stated expressly at the time of purchase. If unsure, check with legal counsel before using this option.

Calculate charges from the due date or invoice/billed date. Typically finance charges are incurred only if not paid by the due date. Confirm due dates are being entered or are calculated based on the terms list. Depending on the type of business and legal contract documentation, it is possible to calculate the finance charge from the invoice date if not paid by the due date. If unsure how this applies to a particular business or industry and to comply with state law, please consult with an attorney.

Mark finance charge invoice to be printed is an option if the finance charge invoice will be printed and forwarded to the customer, sent with a statement, or printed for the business books and records. This is a choice. When a finance charge is incurred, an invoice that includes FC in the number will be automatically generated.

Note: If the finance charge should be assigned to a rep, there are two steps that are critical:

1. The customer must be assigned to the sales rep (Lists > Customer:Job List > Single click on customer > Edit > Edict Customer > Additional Info tab)

2. The finance charge template must be edited to include the rep on the screen (Lists > Templates > Single click on template > Edit > Edit Template > Fields Tab)

5/2/05