17 Nov Extra Credit Card Payments

Extra Credit Card Payments

Making extra payments is an excellent way for businesses to reduce expensive revolving credit card debt. With the ease of online payments for most cards, and the fact that even a few days of less interest can result in notable savings, many business have begun using this as a profit increasing strategy.

For example, an outstanding balance of $10,000 at 15.99% interest is $133.25/month. Making the minimum payment (typically 2%) of $200 barely covers the interest charge. The small amount that goes to reduce the debt will only result in about $1 reduction in the next month’s interest charge. However, making the minimum on the due date, and paying an additional payment will make a significant difference in reducing the principal balance of the debt and therefore reducing the interest charges that continue to accrue.

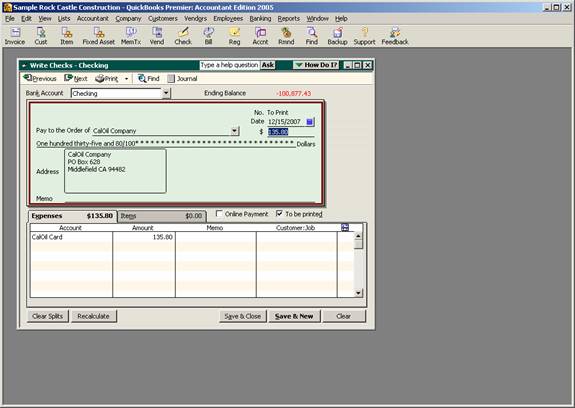

Since the check or bill will not be created as part of the reconciliation process, it will be necessary to manually enter it. The trick to entering the transaction correctly is to code the payment on the expense tab to the credit card type account. This will reduce the credit card liability and record the payment for the next reconciliation.

QBRA-2005: Banking > Write Checks