17 Nov Direct Deposit

Direct Deposit

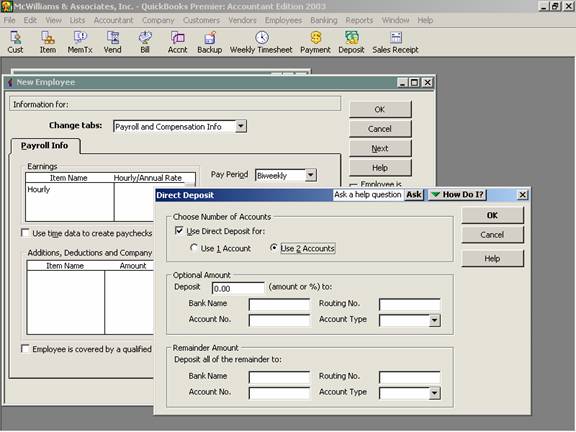

Before using the direct deposit feature to electronically deposit employee paychecks, sign up for the Online Direct Deposit Service through QuickBooks is required. The service is available for a fee for both the Do It Yourself and Assisted services. To edit each employee’s payroll info tab to include the bank information. Up to two accounts may be entered but one will have a dollar amount or percentage, the other will be for the remainder. If an employee chooses direct deposit, there is no way to set up to have part of the check direct deposited and the remainder as a live check unless the paychecks are manually overridden with each payroll.

.

QBRA-2003: Lists>Employee List>Employee>Edit>Payroll and Compensation Info>Direct Deposit

The option is available for the same charge regardless if the net check is deposited into one account or two. To set up direct deposit for the employee, the following information is needed:

q Bank Name

q Routing Number (a 9-digit number found on the bottom of a check between the banking symbols)

q Account Number (found at the bottom of the check, usually to the right of the routing number)

q Account Type (checking or savings)

q If two accounts, dollar amount or percentage to be deposited into the first account (the remainder will be deposited into the second account).

When this process is completed for the first employee, QuickBooks will automatically create a new payroll item called direct deposit on the payroll item list. This new item will be used on the Employee Summary table on the Preview Paycheck Window when payroll checks are calculated. This option will then be available as needed.

Once the payroll has been calculated and submitted to the payroll service, you can only change the memo, check number, print status, cleared status (for reconciling), bank account the check was written from, and the expense and liability accounts effected (if the payroll items are modified). If a check is voided, it will affect the amount of taxes and liabilities due, but the net check amount will need to be returned to the employer from the employee directly. The payroll service cannot impound the employee’s account for the amount due back to the employer for incorrect or voided checks.

TIP: If an employee has chosen to use Direct Deposit, a check will be printed and marked as “Advice of Deposit – Nonnegotiable.” The Direct Deposit amount and QuickBooks fee will be entered into the check register automatically by the software when the payroll is submitted. These entries appear with a lightening bolt symbol next to them to designate that they are electronic transactions.

TIP: Any corresponding charges for use of the direct deposit option will only be incurred if it is used.

TRICK: If the direct deposit box is checked on the “Preview Paycheck” screen when calculating the check, a direct deposit service charge will be incurred even if the net check amount is zero. To eliminate the charge, uncheck the box for this one paycheck.

TIP: The payroll should be transmitted at least two days prior to the pay date to eliminate the warning that the deposits may be late and a fee ($50.00) may be charged.